2020 Logistics IT Market Research Survey

What are the must-have logistics technology solutions? What challenges do software vendors and users face? Find the answers in our annual logistics IT market research report.

Efficient supply chain operations are more crucial than ever. As the world combats COVID-19, hospitals, governments, and suppliers work overtime to get respirators, masks, test kits, and other medical products to facilities that need them, as fast as they can. Whether they staff up to meet this unprecedented challenge, or they get the job done with an existing workforce, companies rely on IT to manage their supply chains as productively as possible. Those that use technology to support demand-driven planning and execution have a leg up in today’s volatile environment.

Sources of Logistics IT Demand

To help logistics professionals plan for the future, Inbound Logistics conducts an annual survey of logistics technology providers. Assembling data on current logistics IT trends, we paint a picture of the capabilities available today and the technology investments shippers are making to gain a competitive edge.

Along with this report, it’s helpful to look at the annual Inbound Logistics Top 100 Logistics IT Providers list, our guide to the leading logistics IT solutions providers in the market. Next time you’re ready to add to your company’s logistics IT tools, you’ll find our guide an invaluable resource.

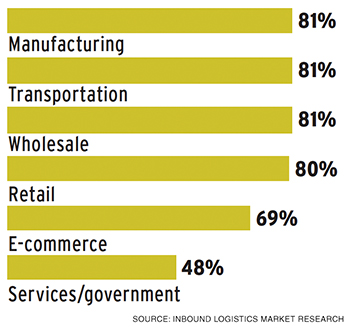

What industries do your solutions serve?

Transportation service providers such as carriers, third-party logistics providers, and freight forwarders have traditionally composed a big market for logistics IT. That’s true in 2020, as well: 81% of respondents tell us they sell to the transportation service industry. But that number has fallen since 2019, when 93% of respondents counted transportation service providers among their customers. This year, three other industries play just as big a role in the market as transportation services: manufacturing (81%), wholesale (81%), and retail (80%).

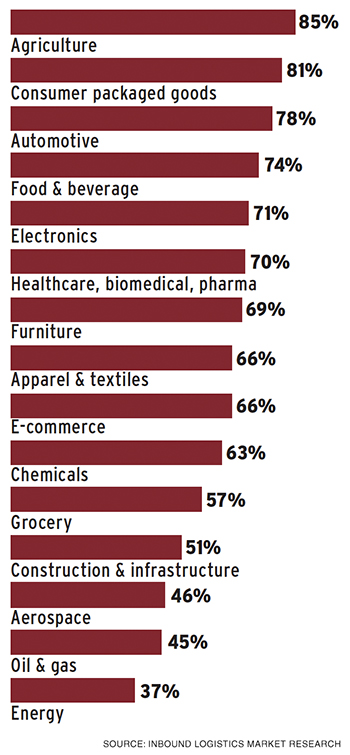

VERTICAL SPECIALIZATION: What verticals do your solutions serve?

Within industries such as manufacturing, transportation, and wholesale, logistics IT vendors serve a wide range of vertical categories. The largest among them—those that provide a market for more than 70% of respondents—are: agriculture (85%), consumer packaged goods (81%), automotive (78%), food and beverage (74%), and electronics (71%).

PLATFORM: How do you deliver your solutions?

If anyone had doubts about the ascendance of cloud computing in logistics IT, this year’s survey clears them away once and for all. In 2019, 55% of respondents told us their solutions were cloud-based, Software as a Service (SaaS), or hosted. But in 2020, 100% of respondents report they offer such solutions. Forty-two percent give customers a choice: they may implement solutions in the cloud or on a customer’s own premises—the same as in 2019. The number of vendors who offer on-premise solutions only—already a mere 1% in 2019—dwindled to zero this year.

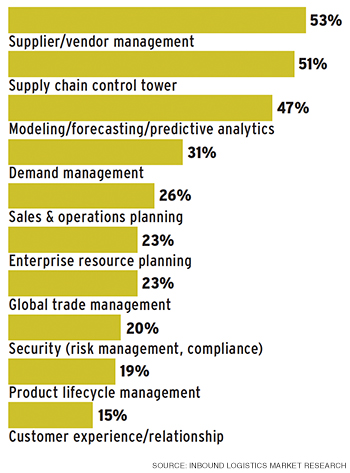

SUPPLY CHAIN SOLUTIONS OFFERED

Beyond solutions for logistics functions, many respondents also provide technology to address broader supply chain concerns. In 2019, 47% of survey takers said they offered solutions for managing vendors or suppliers, and 41% offered supply chain control tower solutions. Those two applications remain at the top of the list in 2020, becoming even more prevalent. This year, 53% of respondents offer supplier/vendor management solutions, and 51% provide control tower capabilities.

One especially striking increase comes in the area of modeling/forecasting/predictive analytics. In 2019, 23% of vendors offered solutions in that category. This year, the number jumped to 47%. Several other areas have seen significant gains as well: demand management (31% in 2020 vs. 25% in 2019), global trade management (23% in 2020 vs. 17% in 2019), and product lifecycle management (19% in 2020 vs. 12% in 2019).

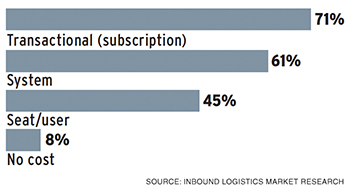

COST BASIS: How do users pay for technology solutions?

Just as some vendors let customers choose whether to implement a solution in the cloud or on premise, some offer a choice about how to pay for their solutions. Among our respondents this year, 71% provide solutions by subscription, slightly down from 75% in 2019. Sixty-one percent will sell a system at a flat rate, an increase from the 48% who named that option last year. In 2020, 45% of vendors offer a per-seat or per-user payment option, and 8% make at least some of their solutions available to users at no cost.

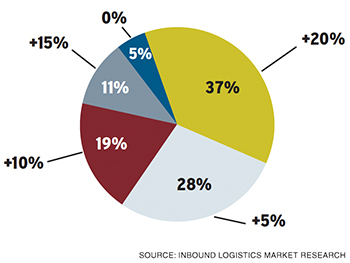

Customer Base: During your last measurement period did your customer base grow? By how much?

Customers’ concerns about transportation and logistics challenges are driving healthy sales for logistics IT vendors. Nearly all respondents—95%—say they have recently seen their customer bases expand (only 5% report zero growth). For 37% of vendors, that growth topped 20%; for 11% of vendors it was by more than 15%; for 19% of vendors it exceeded 10%; and for 28% of vendors it was by more than 5%.

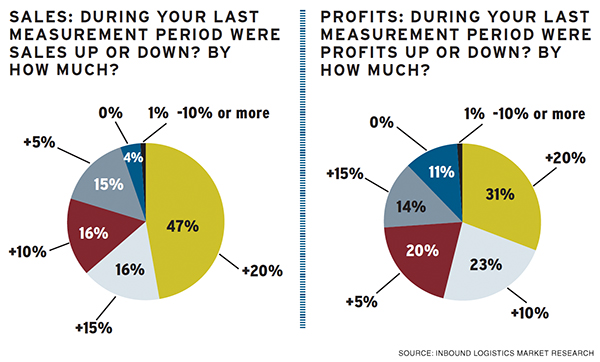

Vendors find new customers in a wide variety of quarters. Asked where they have seen growing demand for logistics technology, respondents offer answers such as: “USA, Latin America, Asia”; “cross-border visibility in Mexico”; “managed services, European markets, retail, food, 3PLs/LSPs, manufacturing”; “zero-touch automation and visibility”; and “U.S. cannabis market.” Whatever drives those customers to seek technology solutions, they have certainly made a positive impact on the balance sheets of logistics IT providers. Among our respondents, almost half report robust sales growth of more than 20%. Only 5% report zero sales growth or decline. Eighty-eight percent tell us they’d seen profits grow in the most recent measurement period. For 31%, profits went up by more than 20%.

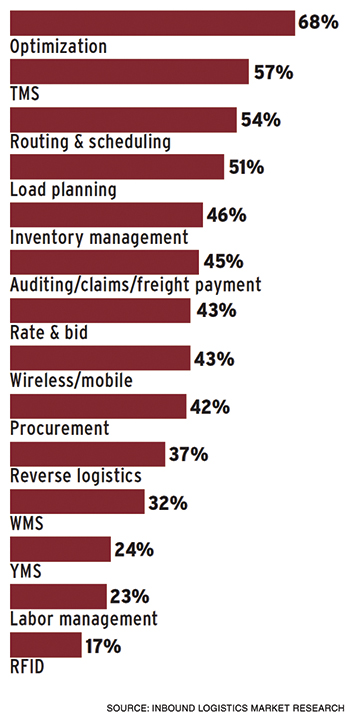

LOGISTICS SOLUTIONS OFFERED

Given customers’ concerns about cost reduction, visibility, and transport optimization, the list of logistics solutions our respondents are most likely to offer should come as no surprise. As in 2019, the top three applications in 2020 are optimization (cited by 68% of vendors), transportation management systems (TMS, cited by 57%), routing and scheduling (54%), and load planning (51%). One category reported by half of respondents in 2019—rate and bid solutions—seems to be slightly less prevalent in 2020; only 43% of this year’s respondents say they offer those products.

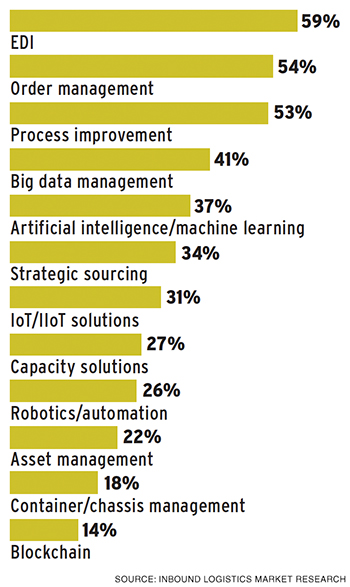

ADDITIONAL SOLUTIONS OFFERED

The survey also asked vendors about additional solutions they offer, beyond logistics and supply chain capabilities. The most popular among those is electronic data interchange (EDI), available from 59% of respondents. Other popular offerings include order management (cited by 54%) and process improvement (53%). In addition, some cutting-edge technologies are starting to gain a foothold in the market. Forty-one percent of respondents say they offer technology for big data management, and 37% say their solutions incorporate artificial intelligence (AI) or machine learning.

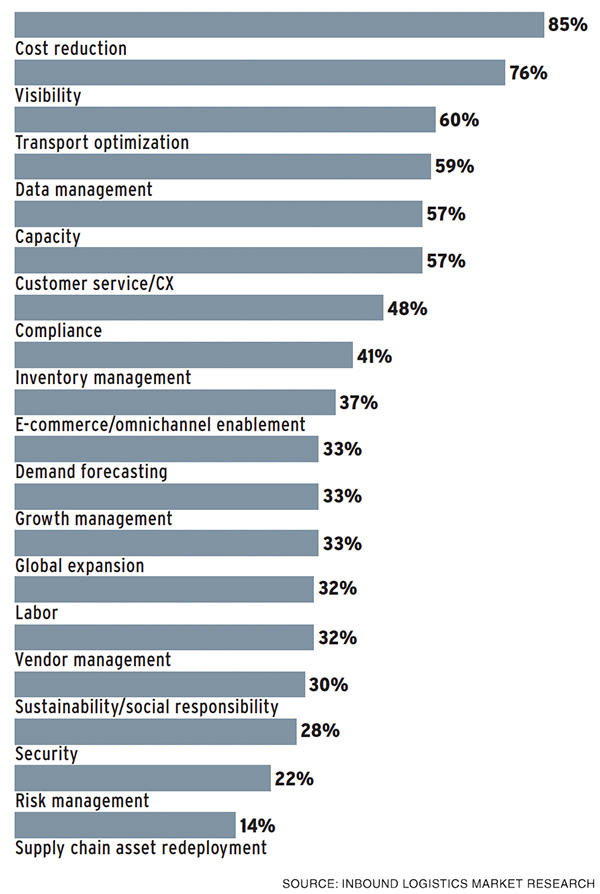

Which transportation/logistics challenges are most critical to your customers?

When shippers implement logistics IT, they tend to have two big goals in mind: reducing costs and gaining visibility. This year, 85% of respondents named cost reduction one of the most critical transportation and logistics challenges for their customers—the same proportion as in 2019. Seventy-six percent of this year’s respondents cited visibility, up slightly from 73% last year.

Other challenges that more than half of respondents called important are transport optimization (60%), data management (59%), capacity (57%), and customer service or customer experience (57%).

Surprisingly, only 37% of logistics IT vendors said their customers consider e-commerce and omnichannel enablement a critical challenge. This comes in spite of the fact that 80% of respondents serve retail customers and 69% serve customers engaged in e-commerce.

Sources of Logistics IT Demand

One question in the annual survey asks software providers to discuss the most important needs their customers address with information technology. Here’s a sampling of responses.

Integration and collaboration

There is a growing demand for technologies that can provide end-to-end visibility and connectivity across the supply chain. The problem is that today’s supply chains are plagued by silos, with stakeholders using their own systems, processes, and key performance indicators (KPIs) within their respective roles. These silos create uncertainties that make it difficult to understand product provenance, track product status and location, and make sound decisions to drive efficiency and business growth.

E-commerce

3PLs and distributors are being challenged to efficiently handle the multichannel requirements of the e-commerce space. The different workflows required by the channel (i.e. direct to consumer) will force companies to update or replace their logistics technology in order to handle new requirements.

Visibility

Because consumers increasingly want to have confidence in the origin of their food, traceability programs are in higher demand in grocery. Additionally, track-and-trace software continues to be top of mind to track shipments throughout their journeys. Consumers expect fast shipping, which leads to higher demand for last-mile delivery programs as well, facilitating faster delivery to end users. There is also a higher demand for visibility among companies, with best ship method technology allowing them to explore a variety of shipping methods based on visibility into product location and availability, as well as vendor drop ship programs to avoid an excess of inventory being shipped to retailers that are unequipped to store or sell it. Transportation management system technologies are also in high demand, because they allow for visibility into consumer demand, which helps strategically manage distribution networks.

As shippers shift their sourcing from China to other regions in Asia, this is increasing the complexity to monitor cargo that requires transshipment routes. We see growing demand for logistics technology visibility solutions that can help U.S. importers measure performance of new suppliers and routes and to manage their incoming cargo as they respond and adjust their shipping patterns to help them grow their businesses.

Expense analytics

Visibility into transportation spending continues to drive the majority of our demand. Customers are becoming more aggressive in their desire and use for spend analytics to gain better control over their transportation spend. The ability to capture, cleanse, and provide visibility into spending trends, KPIs, carrier information, and execution to plan is becoming critical across all industries.

Labor

With an unpredictable labor market and increasing pressure to get more efficient, solutions that allow operations to make more informed decisions and maximize returns from equipment and labor will continue to become more popular in warehouses.

Artificial intelligence

With AI and machine learning data science, supply chains can analyze a vast array of information—from past sales data across thousands of products and hundreds of stores, to weather predictions, and events like football matches—and weigh the factors against each other to deliver accurate predictions of customer demand. Further, companies have become committed to environmental responsibility and are looking for AI-enabled solutions that help them meet their sustainability goals. Though the sustainability challenge grows more complex every day, AI-based tools can consider all the factors that come into play, gather and analyze relevant data, and make the most sustainable and profitable business decisions.

Customer experience

The modern supply chain has become consumerized. Today’s buyers have used their many purchasing options to seize control of their relationships with manufacturers and distributors. They’re buying online by default. They’re overbuying stock with the intention of returning whatever they don’t end up using. They demand speedy—and often even immediate—delivery. They expect retailers to be able to ship items from brick-and-mortar stores, warehouses, or distribution centers to meet their needs. The only way to address these complex problems is to digitize the supply chain so retailers, distributors, and manufacturers have a complete supply chain picture and can make decisions based on real-time information.

Customers are more demanding than ever—placing greater needs on the supply chain to be more intelligent, predictive, and capable of delivering to customers when, how, and where they want it. Like never before, companies rely on their supply chains to deliver differentiated customer experiences and business outcomes. AI-driven supply chain solutions can help leaders innovate and navigate the complexities of today’s global, consumer-driven marketplace.