2022 Logistics IT Perspectives

Companies rely on logistics technology to help navigate a landscape reshaped by a pandemic and evolving customer demand. Our annual logistics IT market research report explores the challenges these companies face and the latest trends in IT solutions designed to meet that need.

More than two years after the start of the pandemic, many companies still struggle with dramatic supply chain challenges. High transportation rates, tight capacity, scarce labor, and ongoing shortages of certain commodities continue to squeeze supply chains.

Where is the Most Demand? Selling

Consumer demand remains strong, especially in the booming e-commerce sector. But companies can seize this opportunity only if they can move products quickly and cost-effectively. The Russia-Ukraine crisis further complicates the picture, pushing up fuel costs and driving fears of economic recession.

Tough times call for smart solutions. That’s why this is a healthy era for vendors of supply chain-oriented information technology. Shippers deploy logistics IT to better match inventory to customer demand, operate more efficiently, accomplish more with tighter resources, and gain crucial business intelligence.

To help manufacturers, distributors, retailers, and others understand how IT solutions can improve their operations, each year Inbound Logistics distributes a survey to a variety of logistics IT providers. Gathering data on the latest trends, we offer insights that logistics professionals use as they invest in new technology.

Once you’ve read this report on our latest survey, have a look at the annual Inbound Logistics Top 100 Logistics IT Providers. When you’re ready to add to your technology toolkit, this detailed guide will help steer you toward solutions that fit your requirements.

PLATFORM: How do you deliver your solutions?

Cloud solutions, also known as software-as-a-service (SaaS) or hosted services, remain the most popular format for logistics IT solutions. Among our respondents this year, 84% say they provide cloud-based solutions, while another 11% offer a combination of cloud-based delivery and on-premise installation. This means that 95% offer some kind of cloud option.

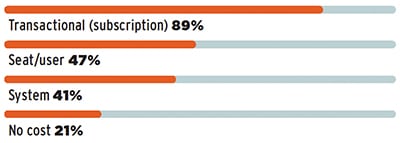

COST BASIS: How do users pay for technology solutions?

Many logistics IT vendors offer multiple ways to pay for their products and services. As more solutions move into the cloud, the transactional or subscription model is becoming more important. In 2022, 89% of vendors let users pay for their solutions by subscription, up from 80% in 2021. Slightly fewer than half—47%—can charge by the seat or user, and 41% charge a flat rate for the system. These figures are similar to last year’s. An increasing number of vendors—21% this year, compared with 15% in 2021—offer at least some of their solutions free of charge. This can happen, for example, when a third-party logistics (3PL) provider or other service provider includes technology in a larger service package.

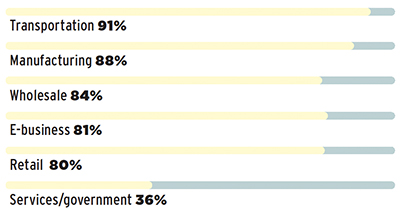

INDUSTRY: What industries do your solutions serve?

As in 2021, the biggest demand for logistics IT is in the transportation industry: 91% of respondents say they serve transportation companies. Two other industries have seen notable changes. While 81% of respondents in 2021 said they served the manufacturing industry, in 2022 that number has risen to 88%. Have more companies—discouraged by the high costs and long delays inherent in supply chains that span the globe—brought manufacturing back to the United States, requiring new technology to support those redesigned supply chains?

We’ve also seen an uptick in the number of logistics IT vendors serving e-business, from 76% in 2021 to 81% in 2022. This is no surprise, given the continued surge in online shopping.

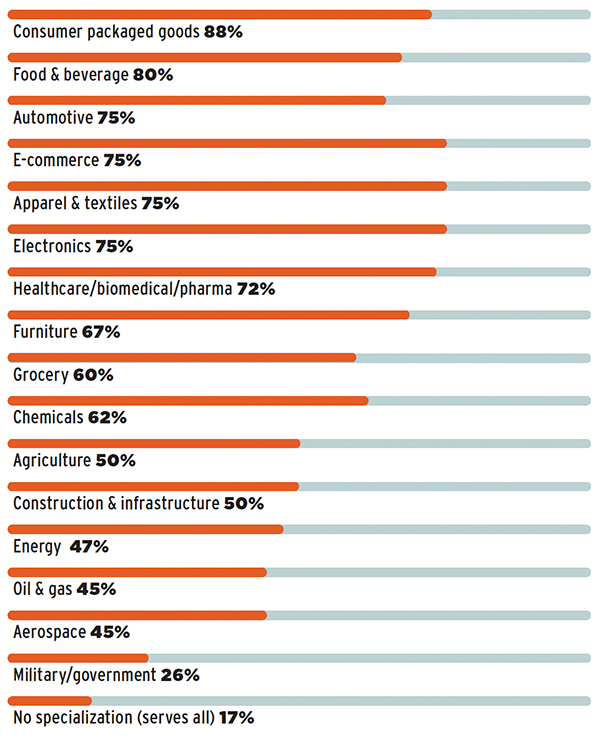

VERTICAL SPECIALIZATION: What verticals do your solutions serve?

The top vertical markets for logistics IT vendors in 2021 remain the top markets list in 2022, in generally the same order. But the percentage of vendors serving several of those industries has jumped. For instance, 88% of this year’s respondents say they service customers in consumer packaged goods (CPG), a 16-point increase over last year. Eighty percent of respondents this year have customers in the food and beverage vertical, compared with 67% in 2021. The survey also shows similar increases in several other verticals. Automotive and e-commerce both increased from 64% in 2021 to 75% in 2022. Apparel and textiles and electronics both rose from 59% in 2021 to 75% in 2022. The healthcare, biomedical, and pharmaceutical sector increased almost as much, from 59% in 2021 to 72% in 2022.

In fact, every vertical market mentioned in the survey is now served by a greater percentage of logistics IT vendors than last year. Clearly, these vendors are finding ways to apply their technologies in a wider range of contexts.

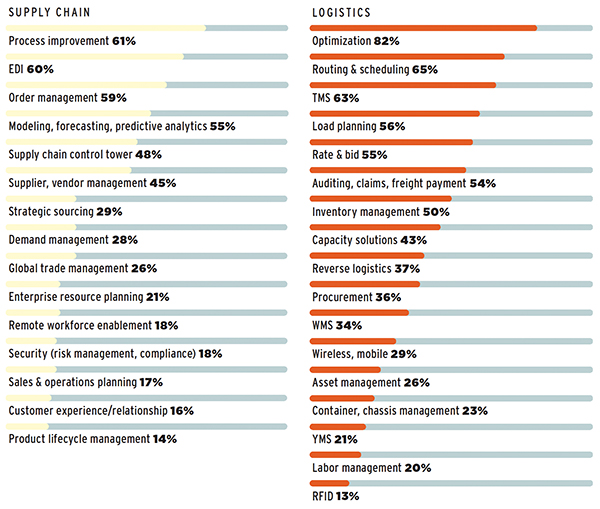

SOLUTIONS OFFERED

The top supply chain solutions offered by IT providers in 2022 are those that support process improvement: 61% of survey respondents provide solutions in that category, up from 56% in 2021. The second most popular is electronic data interchange (EDI), although its position is slipping as companies adopt more advanced data sharing technologies. In 2021, 70% of our survey respondents offered EDI; this year, the number is 60%.

There has been an increase in the number of vendors that provide solutions for strategic sourcing (29% vs. 23%) and global trade management (26% vs. 16%)—both important functions given the challenges that COVID-19 and the conflict in Ukraine have posed to traditional sourcing strategies. There has also been a healthy increase in vendors that offer solutions for demand management, from 17% in 2021 to 28% in 2022.

Among applications for logistics functions, the most striking increase concerns capacity solutions. In 2021, 28% of vendors offered those; in 2022, the percentage has jumped to 43%. Transportation capacity has been in short supply over the past year, with rates rising accordingly. So no wonder more IT companies see opportunities in that area. Logistics solutions getting the most attention from vendors, however, include optimization, routing and scheduling, transportation management systems (TMS), load planning, systems for rating and bidding, and systems from auditing, claims, and freight payment. One category has seen a surprising dip: warehouse management systems dropped from 41% in 2021 to 34% in 2022.

Among the more advanced technologies that companies adopt to manage supply chains, one category has gained a great deal of heat in the past year: artificial intelligence (AI) and machine learning. In 2021, 35% of vendors in our survey offered such solutions; today the number stands at 54%. Advanced technologies offered by a smaller but still healthy proportion of IT vendors include big data management (38%), internet of things (IoT) or industrial internet of things (IIoT) solutions (26%), and robotics or automation (19%).

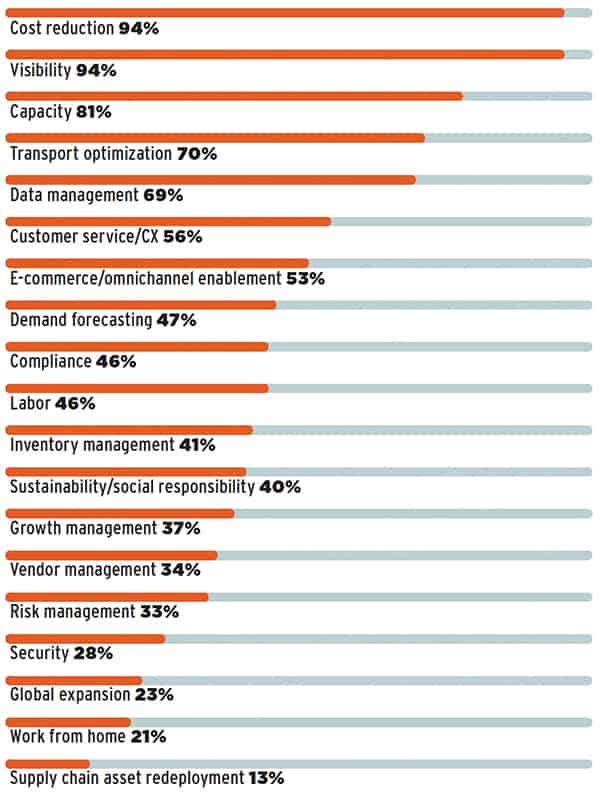

CHALLENGES: Which transportation/logistics challenges are most critical to your customers?

Companies always strive to drive down costs, and shippers always need to know the status of their freight. That’s why vendors in our survey named cost reduction and visibility the two top challenges faced by their customers. But in an era of soaring transportation and fuel costs, intense consumer demand, and long transportation delays, those two challenges have grown even more critical. In 2021, 78% of survey respondents named cost reduction as a critical issue for their customers, and 77% mentioned visibility. This year, 94% of respondents say that each of those issues keeps customers up at night.

Several other challenges are also causing significantly more pain than last year. Notable among them is capacity. In 2021, 58% of IT vendors named that as a crucial challenge for their customers. This year, as shippers compete for space on ships and trucks, and for containers, that number has risen to 81%. Also, in the era of the Great Resignation, there’s a striking increase in the number of vendors who say their customers worry about labor—46% in 2022, vs. 29% last year.

Other challenges that take up more room in customers’ minds these days include data management (69% vs. 57% in 2021), demand forecasting (47% vs. 32% in 2021), and sustainability or social responsibility (40% vs. 23% in 2021).

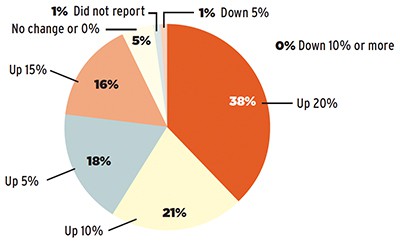

CUSTOMER BASE: During your last measurement period, did your customer base grow? By how much?

Nearly all vendors in our survey saw the ranks of their customers grow in their most recent measurement periods, reinforcing the notion that shippers want technology to help them in today’s complex supply chain environment. And that wasn’t just a token uptick: more than half of respondents—54%—reported customer growth of 15% or more. Another 21% saw their customer base grow by 10%, and 18% saw a 5% bump. Only 1% of respondents say they have lost customers.

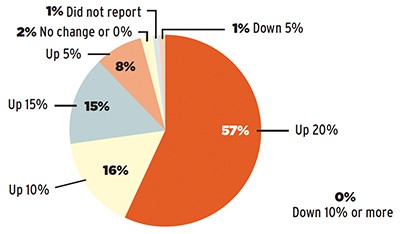

SALES: During your last measurement period, were sales up or down? By how much?

While logistics IT vendors were welcoming new customers over the past year, they were also raking in new dollars. Fifty-seven percent of survey respondents saw sales grow by 20% during their most recent measurement period, an increase over 2021’s already-impressive 40%. Another 15% of vendors saw sales rise by 15%, and 16% of them saw an increase by 10%. Just 2% of respondents reported no change at all in sales, and only 1% noted a drop in sales—and that by just 5%.

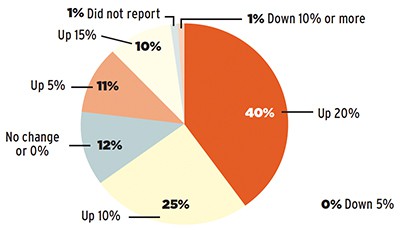

PROFITS: During your last measurement period, were profits up or down? By how much?

While logistics IT vendors were bringing in more revenue, they were also sending more of that money to the bottom line. In 2022, 40% of respondents say their profits were up by 20% during their last measurement period, an even better result than the 30% who reported an increase on that scale in 2021. Ten percent of vendors saw profits increase by 15%, 25% saw a rise of 10%, and 11% saw a rise of 5%.

A significant proportion of respondents—12%—saw profits hold steady in their most recent measurement period. But only 1% of vendors noted negative results.

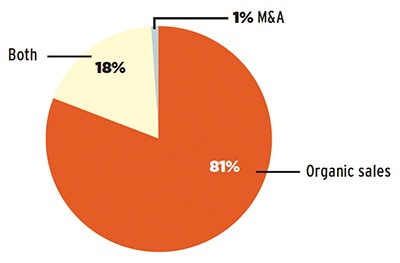

GROWTH: What led to growth in the past year?

A large majority of vendors in the survey—81%—attribute their growth over the past year to organic sales. Just 1% grew through mergers and acquisitions, while 18% say both of those factors helped to enlarge their companies.

Where is the Most Demand? Selling

We asked vendors where they have seen the greatest increase in demand for new logistics technology. Here’s a sampling of their observations:

- “We are seeing a lot of requests lately for complete optimization of supply chains from the inbound side to the last mile.”

- “No longer is there just a driver shortage; there is a worker shortage. AI, analytics, and automation can help LTL companies accomplish more with fewer staff.”

- “Automation of higher-frequency carrier negotiations in sourcing of ocean, air, and ground freight movement to respond to supply chain disruptions or to new changes in supply/demand. Optimization of carrier awarding in sourcing around sustainability goals. Optimization of sourcing decisions for mode-shifting freight movement (i.e. ocean to air).”

- “A lot of new software projects were put on hold in the beginning stages of COVID; things are starting to return to normal and new sales are increasing.”

- “We see growing demand across all the regions and verticals we serve, with the biggest growth coming in life sciences and consumer products.”

- “We see an increase in demand for a logistics platform that supports smarter operational decisions, integrating operational, tactical, and strategic decisions to make daily decisions in line with the tactical and strategic targets and parameters of the current scenario.”

Where the Challenges Lie

Changes sparked by COVID-19 and the ongoing rise of e-commerce pose many of the challenges that shippers confront today, according to quite a few logistics IT vendors who responded to our survey.

Take warehouse operations. “Warehouse capacity is extremely tight,” says Geoff Greenhill, director of sales at Camelot 3PL Software in Charlotte, North Carolina. As increased consumer spending drives demand for space, warehouse rent and construction costs are both going up, he says.

E-commerce fulfillment doesn’t need as much real estate space as traditional retail distribution. “But it needs more labor,” Greenhill says. Due to shortages across all industries, exacerbated by the pandemic, workers are hard to come by even at today’s elevated wages. Companies either spend more on workers or they spend on automation to close the labor gap. “Everything is pointing toward higher costs to operate,” he says.

Camelot helps control those costs by setting up more efficient warehouses, for example by integrating technologies such as robotics and automated forklifts, Greenhill says.

Customer demand for faster e-commerce delivery drives a need for better inventory management and visibility, says Padhu Raman, chief product officer at Project Verte, an Atlanta-based firm that offers a cloud-based supply chain platform powered by artificial intelligence (AI). “This challenge is more prominent right now, with changes in customer expectations.” As consumers demand a better shopping experience and greater convenience, brand owners sell through multiple channels to connect with as many customers as possible, he says.

Project Verte’s technology helps companies gain the visibility they need to streamline e-commerce fulfillment. “We provide a hub where they can integrate into the platform and get the data centralized in one view,” Raman says. Among other functions, the technology also helps shippers improve their parcel shipping, consolidating packages to save money on linehaul shipments and last-mile delivery.

For retailers who use supply chain technology from Inmar Intelligence, in Winston-Salem, North Carolina, the biggest challenges right now involve formulating strategies for the future, says Joe Marcaurelle, director of product strategy for the company’s supply chain division. “These retailers incorporated a lot of new processes and technologies during the pandemic to keep up with new customer expectations and stores not being able to be entered.”

Now they have a chance to determine which business trends applied only during the pandemic and which represent permanent change. “They’re starting to evaluate what technologies they need to bring them into the future of where they think the economy is going,” he says.

Inmar helps its customers stitch together various technologies—Inmar’s own and its partners’—to provide an end-to-end picture of their businesses, Marcaurelle says.