Manufacturers Are Optimistic; Truck Drivers Want Better Pay and Equipment; and Other Supply Chain News

Takeaways that are shaping the global supply chain.

Equipment and Pay Will Make Drivers Stay

Despite signs of improvement in the freight market, carriers and drivers continue to grapple with the lingering effects of the freight recession. Competition for drivers is intensifying, leading to a rise in driver turnover as evidenced by an increase in CDL driver job postings and truck driver job seekers. This is the key message from the Q1 2024 Driver Recruiting & Retention Data Download Report, compiled by Conversion Interactive Agency and People. Data. Analytics. (PDA).

“It’s crucial for carriers to reassess their recruitment and retention strategies,” says Kelley Walkup, president and CEO of Conversion Interactive Agency. “Several Q1 data points indicate that driver demand is increasing. With many carriers seeing improvement in freight volumes, now is the time to review the driver pipeline and be ready for the rebound.”

The Q1 data highlights equipment and compensation as drivers’ top concerns and the main reason drivers voluntarily decide to leave their carrier. However, there was a notable shift in compensation issues, with fewer drivers attributing pay problems solely to miles.

Here’s a closer look at what the data indicates:

- Driver messaging is important for recruiting and retention. “Amidst evolving trends in driver pay and competition dynamics, it’s imperative for carriers to deliver accurate equipment and pay messaging in their recruitment marketing,” notes Walkup. The Q1 data shows “pay” and “equipment” were top keywords from online driver reviews last quarter.

- Today’s drivers also emphasize the need for predictable pay in the current freight market. “Implementing strategies to maintain consistent movement for drivers and ensuring their expectations are aligned appropriately are crucial steps in addressing pay-related concerns,” says Scott Dismuke, vice president of operations at PDA. “Ultimately, the significance of a higher pay rate diminishes if drivers are not consistently logging miles.”

- Compensation concerns go beyond mileage. Q1 2024 marked the first time in five quarters that fewer than half of drivers surveyed attributed their compensation woes to miles. “Compensation became the top worry for drivers for the first time since late 2022. Fewer drivers are talking about miles, while more are talking about pay rate,” Dismuke added. “There has been a 3% drop in issues related to miles. This suggests a significant change in driver priorities, as compensation concerns now take precedence over the traditional focus on miles driven.”

Manufacturing Optimism Rebounds

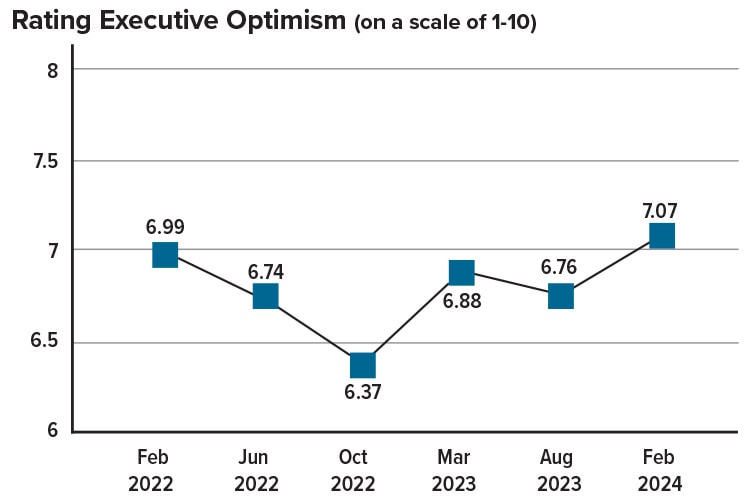

The manufacturing sector is feeling upbeat again, reporting the highest levels of optimism since June 2021, according to the latest Sikich Industry Pulse Report. The manufacturing executives surveyed rate their optimism an average of 7.07 on a scale of 1 to 10, the highest rating in the past three years. (See Rating Executive Optimism chart.)

Contributing factors include an increase in customer demand and a decrease in labor challenges. Respondents also cite supply chain improvements and favorable economic conditions as reasons for increased optimism.

The survey also asked executives to determine which factors represent the greatest challenges to their business in the upcoming year. Labor shortages/increased labor costs (31%) continue to be a top issue. (See Top Challenges for 2024 chart.) Despite these challenges, business leaders are still prioritizing growth but doing so conservatively. They report being focused on existing products in current markets, with market penetration (40%) as their primary growth strategy.

New Exec Must-Have: GenAI Training

Continuing to create buzz across the supply chain sector, generative artificial intelligence (GenAI) is at the top of the priority list for most companies today. A new Accenture survey shows 87% of C-suite executives responsible for supply chain and production plan to invest more in GenAI. And 85% expect to reap the returns of their generative AI investments already in 2024.

But the survey shows these executives also recognize they need to better understand the technology and its potential, and they need widespread GenAI training across their organizations. Only 15% are highly confident they currently have the right data strategy and digital capabilities to use generative AI effectively.

Other interesting takeaways on GenAI training perceptions:

- 74% of respondents feel they need at least some level of training in GenAI.

- 18% recognize the necessity for extensive training in this area.

- 42% claim to be personally using GenAI tools at least once per week, down from 71% just six months ago.

- 54% believe their organization requires intermediate-level training in the technology, such as prompt engineering and model fine-tuning.

- 40% think the most crucial need is advanced training, such as developing GenAI models and applications.

Decoding Europe’s New Cargo Code

The European Union recently updated its Union Customs Code, which affects companies involved in transporting cargo to or through the EU.

The changes are a direct result of the Import Control System (ICS2) rollout, which is the third release of the new pre-arrival and security system for the EU. The ICS2 mandates that all bill of lading issuers provide advance cargo information to address security and safety concerns associated with incoming shipments entering the EU. Shippers must comply by submitting a comprehensive set of Entry Summary Declaration data for goods crossing the EU border, regardless of whether they are inbound or outbound.

What’s the impact? Here are the key points, according to Bryn Heimbeck, president of Trade Tech:

- Failure to comply with these new regulations will result in cargo shipments being halted and delayed at EU customs borders, with customs authorities withholding clearance.

- Insufficient declaration will either be rejected or subjected to intervention, potentially resulting in noncompliance penalties. “It is strongly advised that shippers prepare ahead in order to prevent disruptions to their shipments bound for or passing through the EU,” notes Heimbeck.

- Shippers can help to ensure compliance by utilizing unified platform technology that aligns with the enhanced requirements of ICS2. This type of technology is designed to integrate new regulatory changes and is built on top of existing systems and processes. “By adopting a unified platform technology, shippers can bridge the regulatory gap when it comes to global security filings such as AMS, ISF, and the latest addition, ICS2,”says Heimbeck.

Planning Gets Priority

Given the extreme supply chain disruptions companies have faced in the past few years, it’s no surprise that crisis mitigation and prepping for disruptions have become increasingly important.

New data from intelligent planning technology provider Board International confirms this: Senior supply chain professionals are placing a renewed focus on scenario planning in response to a volatile business landscape, according to the new Board 2024 Global Planning Survey.

Overall, 73% of decision-makers are taking planning more seriously, with the Ukraine War, cost-of-living crisis, and ongoing supply chain disruptions acting as major catalysts, the survey shows.

The key business threats decision makers are currently planning for:

- Cyberattacks: 36%

- Labor shortages: 35%

- Fluctuating oil prices: 34%

- Blockage of key supply chain channels: 27%

Despite an emphasis on planning to help navigate ongoing disruptions, many supply chain professionals continue to face challenges planning effectively. The survey reveals signs of planning fatigue within many companies, highlighting a 14% decrease in how seriously companies are taking planning compared to last year. In addition:

- 77% of supply chain decision makers admit their organization makes planning decisions based on assumptions.

- 29% of respondents report that ineffective planning has impacted profitability, productivity, and the ability to drive innovations and new products or services.

- 72% of supply chain professionals usually disregard the most extreme scenarios when planning, suggesting most companies are leaving themselves open to risk should the unexpected happen.

Sounding off on Tariff Increases

In May 2024, the White House announced a flurry of tariff increases impacting imports of everything from electric vehicles (tariffs are raised from the current 25% to 100%) to lithium-ion EV batteries (jumping from 7.5% to 25%), steel and aluminum products (increasing from 7.5% to 25%), and semiconductors (raising from 25% to 50%), among others.

What’s the impact? Here’s what experts are saying:

—Simon Geale, Executive Vice President of Procurement, Proxima

—Keith Hartley, CEO, LevaData

—John Donigian, Senior Director of Supply Chain Strategy, Moody’s Analytics

Which 25 Supply Chains Are Tops?

Schneider Electric retained the #1 position, followed by Cisco Systems, Colgate-Palmolive, Microsoft, and Johnson & Johnson, in Gartner’s recently announced Global Supply Chain Top 25, which recognizes leading supply chain organizations and identifies the underlying trends that drove their performance. This year marks the 20th annual list, which often includes major international brands.

New to this year’s list was NVIDIA, which made its debut in the seventh position.

The Top 25 companies are overcoming challenges and obtaining supply chain excellence through several key strategies, according to Gartner analysts. To address workforce concerns, they consistently fund people-centric strategies to drive higher engagement from their workforce.

When it comes to technology, the Top 25 supply chains are built on solid foundations in data and digital capabilities and they evaluate both traditional (non-generative) AI techniques and GenAI to build practical use cases that benefit most from AI-driven advances. Additionally, chief supply chain officers and their teams at these top-performing companies embrace uncertainty, learn from it, and evolve toward an anti-fragile supply chain.

Here are Gartner’s 25 picks:

1. Schneider Electric

2. Cisco Systems

3. Colgate-Palmolive

4. Microsoft

5. Johnson & Johnson

6. Diageo

7. NVIDIA

8. The Coca-Cola Company

9. Walmart

10. Lenovo

11. L’Oréal

12. AstraZeneca

13. PepsiCo

14. NIKE

15. Intel

16. Siemens

17. Nestlé

18. Inditex

19. Dell Technologies

20. Pfizer

21. HP

22. Danone

23. BMW

24. Heineken

25. JD.com