TAKEAWAYS: Shaping the Future of the Global Supply Chain

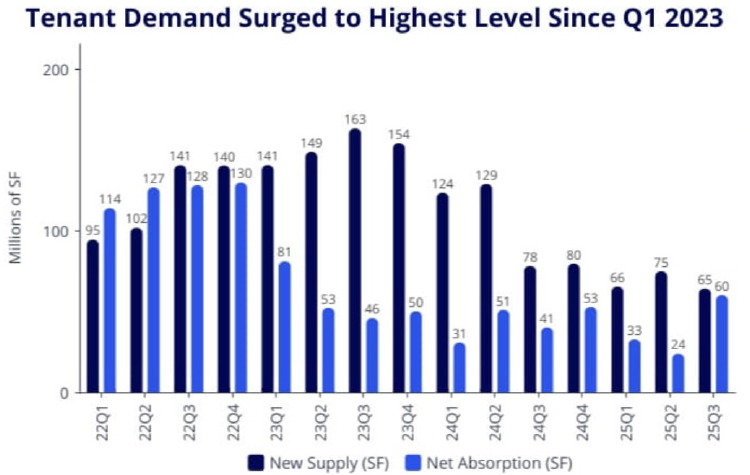

65M SF of new supply in 25Q3 ↓ 14M SF YOY

60M SF of net absorption in 25Q3 ↑ 20M SHF YOY

Industrial Market Finds Balance

Industrial real estate in the United States appears to be settling into a more balanced phase. According to the Colliers Q3 2025 Industrial Market Report, tenant demand surged while new construction cooled substantially, signaling a potential turning point for warehouse and logistics networks.

Net absorption hit roughly 60 million square feet in Q3—the strongest quarterly total since early 2023, the report shows (see chart, above). At the same time, industrial vacancy ticked up only slightly to 7.4%, while the pipeline for new buildings shrank to 270 million square feet, a level not seen since 2018. These shifts suggest that supply is tightening even as demand remains solid.

Here are some other interesting trends on display in the Q3 report:

Flight to quality: Tenants are showing preference for modern, efficient facilities—especially near ports, rail hubs, and ecommerce corridors.

Tightening cost structures: With demand up and supply constrained, building and lease costs are rising. Carriers, third-party logistics providers, and shippers must factor higher real estate and occupancy expenses into their planning.

Strategic site selection matters: As supply growth cools, companies are placing greater emphasis on location, connectivity, and automation readiness.

Opportunity window for logistics optimization: Given the supply-demand shift, companies that move quickly to secure prime space and optimize their networks can gain a competitive edge.

Tech Takes Priority

As the supply chain sector heads into 2026, one thing is resoundingly clear: Technology is now a necessary strategy, not just a supportive tool. As a result, tech spend is trending upward, with visibility solutions topping the list. That’s the main takeaway from a new report by Ontegos Cloud, which surveyed 912 logistics and supply chain professionals across North America, Europe, and Asia.

Additional insights about the coming role of technology in 2026 include:

Source: Ontegos Cloud

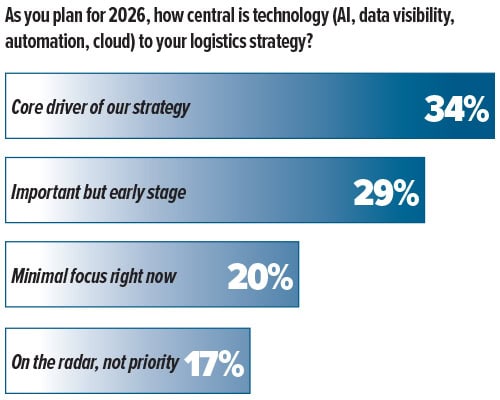

Digital-first confirmed: One in three respondents (34%) identify technology as the core driver of their logistics strategy, highlighting an industry-wide shift toward digital-first operations among freight forwarders and 3PLs (see chart, left).

Predictive visibility dominates: 44% of respondents say forecasting and visibility are their top technology focus area for 2026, surpassing automation, digital twins, and cybersecurity.

Spending spree: Nearly 40% of freight forwarders and 3PLs are dedicating more than one quarter of their 2026 budgets to technology. Another 25% plan moderate increases (10% to 25%), while only 23% remain cautious with limited allocations under 10%.

Potential security oversight: Only 11% of freight forwarders and 3PLs selected cybersecurity and compliance as a focus area, highlighting a potential vulnerability as data connectivity and automation deepen across global supply chains.

Future Watch: Supply Chain 2030

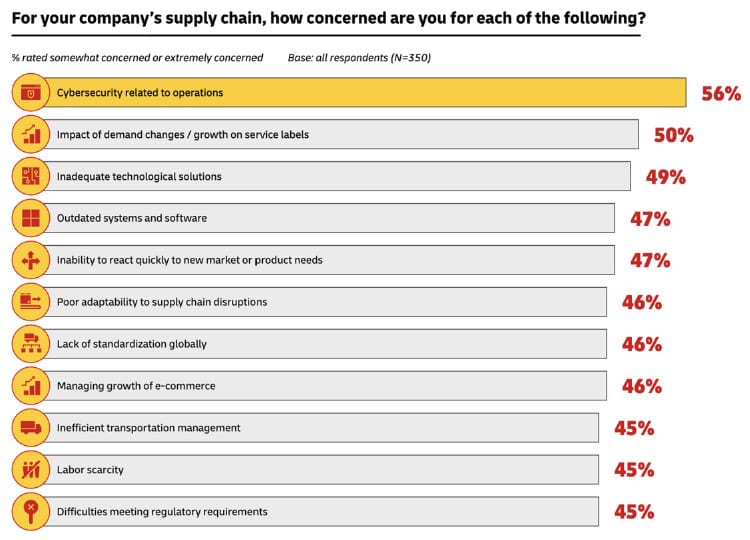

Learning to live with supply chain disruptions has been a top priority for logistics leaders over the past few years—and that pattern is likely to continue, according to a newly released survey from DHL, Insight 2030: Opportunities and Challenges for the Supply Chain of the Future. Participants rank challenges stemming from disruptions, placing cybersecurity as the top concern (see chart, above).

The survey also finds that 99% of executives view the supply chain as critical to business success, 73% expect their supply chains to be more reliant on AI, and 70% anticipate cybersecurity threats to disrupt operations by 2030. As a result, a strong majority of respondents expect to become more dependent on established and emerging technologies in the next five years.

Current technology use is prevalent, with more than two-thirds of survey participants citing core warehouse and transportation management systems in place, and 91% of those saying their warehouse management system had been installed or upgraded in the past five years.

“While advanced systems and increased automation have become essential in managing the modern supply chain, these technologies also bring their own set of concerns, as well as implementation and management challenges,” says Mark Kunar, CEO of DHL Supply Chain North America.

The report benchmarks the current state of the supply chain, identifies the most significant changes expected by 2030, and provides insight into the obstacles leaders face in ensuring their supply chains continue to support business objectives. Additional findings include:

- Rapid technology evolution emerged as a key concern with about half of participants pointing to “inadequate technological solutions” (49%) and “outdated systems” (47%). In addition, only 34% of VP and Director level executives were fully satisfied with their use of technology.

- Robotics represents another opportunity to increase productivity: 68% of participants expect increased dependence on robotics to perform routine tasks, though less than half of participants (44%) have deployed warehouse robotics, and only 34% of VP and Director level executives were fully satisfied with their use of the technology.

- 70% of survey participants anticipate cybersecurity threats will impact their networks through 2030. Other disruptive forces cited include higher labor costs (69%), labor shortages (66%), natural disasters (63%) and international tensions (62%).

- 63% of respondents predict an increased focus on the ability to orchestrate supply chain resources to reduce costs.

In Memoriam: Lisa H. Harrington

Lisa H. Harrington, a highly respected and principled voice in supply chain and logistics, passed away on November 11, 2025. Over many years of dedicated service, scholarship, and writing, Lisa made profound contributions—not only to Inbound Logistics as a writer and contributing editor, but also to academic research, consulting, and mentorship—that have shaped the field in lasting ways.

Lisa H. Harrington, a highly respected and principled voice in supply chain and logistics, passed away on November 11, 2025. Over many years of dedicated service, scholarship, and writing, Lisa made profound contributions—not only to Inbound Logistics as a writer and contributing editor, but also to academic research, consulting, and mentorship—that have shaped the field in lasting ways.

Her name appeared repeatedly in our pages over the years; her thoughtful articles translated the complexities of supply chain and logistics management into accessible insights. But her influence extended well beyond our magazine. As senior research scholar with the UMD Center for Public Policy and Private Enterprise at University of Maryland, Lisa tackled some of the most critical issues in modern supply chain strategy: risk, sustainability, disaster relief, and global health logistics. Her work informed both public-sector and private-sector leaders—from the Department of Defense and NASA to multinational corporations such as FedEx, Caterpillar, and Microsoft.

Lisa was also a committed educator, author, and thought partner. She co-founded the Sustainable Supply Chain Foundation, bringing together academics and business practitioners to drive real-world change. Her three books—X-SCM: The New Science of X-treme Supply Chain Management; In Real Time: Managing the New Supply Chain; and Logistics and the Extended Enterprise—will continue to guide and inspire students, executives, and scholars alike.

She believed deeply in sharing knowledge, mentoring young practitioners, and bringing voices together across sectors. Lisa’s leadership extended into board service and institutional engagement: she was active in professional associations such as the CSCMP-Council of Supply Chain Management Professionals and the Warehousing Education and Research Council (WERC). Through her consulting firm, she helped organizations build more resilient, responsive, and ethical supply chain systems.

Lisa’s passing leaves a void in the supply chain community—but her legacy remains alive in the ideas she championed, the frameworks she built, the articles she penned, and the people she mentored.