VERTICAL FOCUS: Perishables

Grain Pain

As with many other sectors, transportation disruptions have hit the perishables industry in 2022. The American Farm Bureau Federation (AFBF) released its mid-year status update on transportation systems in the United States—and, as you might expect, the numbers are troublesome.

- Total grain rail cars loaded and billed dipped slightly, from 381,000 cars in Q1 to 373,000 cars in Q2.

- BNSF and Union Pacific (UP), which processed 64% of all grain rail cars in Q2, shipped 9% and 14% fewer grain rail cars than the same period last year, respectively.

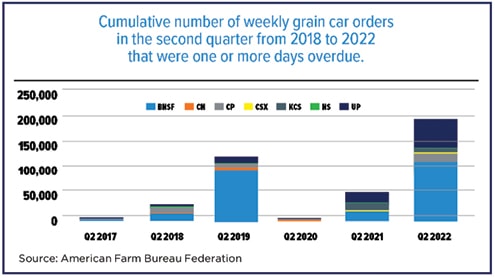

- Between Q2 2021 and Q2 2022, the number of cumulative unfilled orders—the number of cars a shipper (such as a grain elevator) ordered but did not receive—jumped from 62,000 to 204,000, a 231% increase. Year-over-year, BNSF saw a jump of over 110,000 cumulative unfilled orders (+546%) and UP saw an increase of 33,000 (+154%). Comparing Q1 2022 and Q2 2022, there has been a 49% (66,000) increase in cumulative unfilled grain car orders one or more days overdue.

- Of the 204,000 cumulative unfilled grain car orders one or more days overdue, nearly 70% (or 140,000) were also 11 or more days overdue—a 348% increase from the second quarter last year and an 82% increase from last quarter.

- In Q1, bidders faced a nearly 500% increase in secondary railcar auction bids from the prior four-year average (between BNSF and UP).

- On what the AFBF calls “a marginally higher note,” secondary market bids for shuttle service have cooled for deliveries to be made in August from highs for deliveries made in April.

“Rates remain volatile and well above average,” the AFBF reports. “Shippers with flexibility in moving product may participate in the secondary market to take advantage of high bids for existing contracts, further contributing to delivery uncertainty.”

Sustainability Data Goes Digital

Tracking fresh produce shipments is becoming more eco-friendly. Consentio, a digital trading platform with customers across Europe and North America, is adding sustainability data to its offering. This allows produce traders to monitor carbon dioxide and water consumption data in their transactions.

Consentio’s platform follows fresh produce transactions from grower to distributor to retailer. The new sustainability data, which will be displayed along with price and availability, comes from accredited government sources, the company says.

More sustainability features are on the way, “such as details of the grower and the produce journey from farm to fork,” CEO and co-founder Benoit Vandevivere told Perishable News.

“The entire world of food production and supply is changing rapidly,” he said. “Consumers want to know more about the food they eat, where it was produced and when, what the carbon impact has been during the food production, and much more.

“Retailers are now looking for suppliers who can provide true and verifiable provenance with transparent supply chains, meaning some food producers are finding

Keeping Milk Moo-ving

Few products go bad quicker than milk. Yet many dairy supply chains are stuck in an analog, pen-and-paper legacy universe. One company, Milk Moovement, is working to change that, with cloud-based software that uses data to speed perishable deliveries.

Introduced in 2018, Milk Moovement helps dairy farmers and distribution partners track and route shipments in real time and access information about the quantity and quality of the milk being shipped. The company recently raised $20 million in a Series A round to boost product development and help market the technology platform throughout North America.

Milk Moovement will use the funds to expand its engineering team in order to segment its site for different departments, such as logistics and transportation, processing, and payments. The company, which currently employs 55 people across Canada and the United States, plans to grow to 75 or 80 employees by the end of 2022.

Dairy cooperatives were the first users of the software, but in recent years, the company has moved into other industry areas, including dairy farmers and truckers. The software helps perishables producers by providing “frictionless access” to data, according to Robert Forsythe, CEO of Milk Moovement. “We don’t create new data—the data’s out there,” he says. “It’s about getting it in their hands faster so that they can make improvements.”

An Egg-cellent Partnership

Happy Egg Co. is about to make more customers happy. Its free-range eggs will now be available in Florida, California, Nevada, Oregon, and Washington, thanks to a new partnership with Fresh Del Monte and Trinity Logistics, to supply and fulfill its orders across the United States.

With temperature-controlled warehouses throughout the country and a large truck fleet, Fresh Del Monte provides perishables shippers like Happy Egg with drayage, refrigerated warehouse services, refrigerated LTL distribution, last-mile delivery, cross-dock, ripening services, and truckload brokerage services. A partnership with Trinity Logistics enhances its time-sensitive freight delivery capabilities.

“We’re always looking for ways to work with other companies and help them utilize our vast logistics network to provide high-quality products to the end consumer,” says Mohammed Abbas, Fresh Del Monte’s chief operating officer. Fresh Del Monte also owns Network Shipping, a global third-party shipping network, and Tricont Trucking and Tricont Logistics.

A Fresh Start

The fresh meal market seems to be one bright spot in an otherwise challenging business climate. Investors have placed their bets on FreshRealm, a provider of fresh meals for retailers nationwide, to the tune of a $200 million capital raise.

The market, valued at $30 billion, remains strong as busy consumers continue to look for fresh and convenient prepared meals. FreshRealm says it is the only provider with a national platform for simple delivery of fresh, ready-to-cook, ready-to-heat and low-prep meal kits. The company supplies about 10,000 retail locations and more than one million direct-to-consumer customers, it says.

The company will use this latest capital infusion—on top of the $32 million raised in 2021—to:

- Expand operational facilities nationwide to address growing retailer demand for fresh meals.

- Deliver more than 400 million meals to consumers nationwide.

- Expand production to service additional retail channels, including convenience and club stores.

- Access culinary expertise and proprietary consumer data to boost sophistication and customization in meal development for retail customers and end consumers.

- Improve equipment, facility technology, and production capacity to increase efficiency within its horizontally integrated operations model.

- Bolster supply chain security.

- Create new technology solutions to manage scale and complexity of meals and ingredients across its customer base and channels.

“As the retail fresh meals category continues to demonstrate compelling growth, this funding allows FreshRealm to bolster our existing end-to-end platform that supports elevated private label and branded meal assortments and fresh meal destinations,” says Michael Lippold, founder and CEO.