Is Your 3PL Financially Healthy?

An ounce of prevention is worth a pound of cure. Conduct a financial checkup of your potential 3PL partners before you sign the contract.

Although we seem to be climbing out from the lowest points of the recent recession, a great deal of financial instability still plagues the logistics sector. Fiscal cliffs, tax reforms, fluctuating fuel prices, labor issues, regulatory revisions, and superstorms provide a non-stop parade of factors affecting both daily operations and long-term objectives for supply chain and logistics networks.

Outsourcing Spending Patterns Persist

Financial Checklist for 3PL Relationships

3PLs Deliver Measurable Results

To succeed in business, you need to be constantly vigilant in assessing the effectiveness of your practices and partnerships. The lowest price for service might look more attractive than ever, but will it provide the value you need to retain customers and grow your business?

One of the most important supply chain relationships is between shippers and third-party logistics (3PL) providers. 3PLs do much more than just deliver product. They often handle warehousing, distribution, and customer service. And, a 3PL’s use of cutting-edge technology and engineered solutions can reduce your costs and increase your competitive edge.

It is important to select a stable 3PL with a good financial track record, especially if you are signing a multi-year contract. Effective 3PLs must be financially sound and willing to invest in their own business.

Your relationship should start with a critical review of your potential 3PL partners’ financial health. Not only will a thorough evaluation protect your supply chain and customer base, but it will also ensure that the 3PL you select will be a long-term partner.

Why worry?

Though not as gloomy as a few years ago, the current uncertain economy continues to require rigorous review when selecting a 3PL.

On the positive side, the Korn/Ferry Institute’s 2013 17th Annual Third-Party Logistics (3PL) Study reports an optimistic outlook for the industry. Based on responses from more than 2,300 shippers and logistics service providers in North America, Europe, Asia-Pacific, Latin America, and other regions, the study indicates that despite challenging business conditions, global revenues for the 3PL sector continue to rise as service providers work to improve their business presence and create value for customers.

In addition, 65 percent of shipper respondents report an uptick in their use of 3PL services, and say they are increasingly satisfied with their 3PL relationships.

“Both shippers (86 percent) and 3PL providers (94 percent) view their relationships as successful, with shippers posting some impressive results from outsourcing; slightly more than half say their use of 3PLs has led to year-over-year incremental benefits,” according to the study.

Shippers also report significant savings from logistics cost reductions (15 percent), inventory cost reductions (eight percent), and logistics fixed-asset reductions (26 percent). “And, shippers are more satisfied than 3PLs (71 percent to 63 percent) with the openness, transparency, and good communication in their relationships, while 67 percent of shipper respondents judge their 3PLs as sufficiently agile and flexible,” the study notes.

Despite those findings, many risk factors still cause concern, cautions the Center for Supply Chain Research at Pennsylvania State University’s Smeal College of Business.

“Today’s complex supply chains are more vulnerable than ever before to negative impact from disruptive events, and shippers are becoming increasingly demanding of their 3PLs’ risk mitigation capabilities,” according to the Center. “A number of factors—including extended supply chains, reduced inventories, and shortened product lifecycles—are making supply chain disruption both more likely and more costly.

“Economic losses from supply chain disruptions increased 465 percent from 2009 to 2011, while at the same time, the number of companies experiencing supply chain disruption grew by 15 percent,” the Center notes. “The Korn/Ferry report highlights adverse weather, and the threat of a pandemic, as the biggest sources of supply chain disruption, cited by 69 percent of shipper respondents. Commodity, labor, or energy cost volatility is the second, cited by 59 percent of shipper respondents.”

The higher risks 3PLs face are accompanied by extreme pressure from banks that are significantly restricting lending practices. 3PLs are also pinched between customers who make extended payments and workers who must be paid weekly. Historically, 3PLs have funded operating costs, lease commitments, and capital investments. With less bank funding, many 3PLs now face cash flow shortages, increased interest costs, and over-extended credit.

keeping up

While technology plays an increasingly important role in supply chain operational efficiency and risk mitigation, many 3PLs don’t have the resources to keep up. Despite the increased risk of supply chain disruption, many companies are currently underfunding disruption-mitigation planning. Without more advanced strategies in place, 3PLs will not be as effective at minimizing the risk of disruptions, The Center for Supply Chain Research study reports.

Ask yourself: Do my 3PL partners have the financial stability to weather significant disruptions, especially when access to capital is more restricted? And, are they in a good position to take advantage of innovations that will both protect and advance my business?

When evaluating a 3PL as a potential partner, perform a rigorous due diligence review. To conduct this financial review, rely on independent sources, as well as information the 3PL provides. If it wants your business, the 3PL should be more than willing to help you qualify its financial standing.

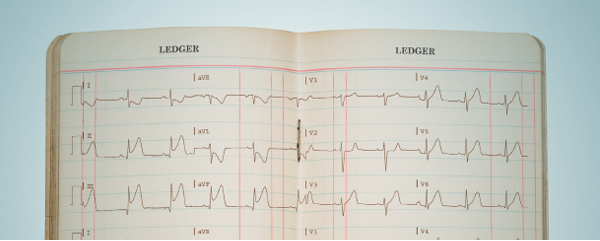

Look for data—balance sheets, income statements, cash flow records, and financial statement footnotes—for at least the past two years. Check bank references, and make sure the 3PL’s certificates of insurance provide enough coverage to meet your minimum levels.

If the 3PL is a public company, its 10K annual report and most recent 10Q quarterly report should provide much of what you need. If the 3PL is privately owned, ask for copies of the most recent financial reports, and talk with its finance personnel if you have questions.

When you review a 3PL’s financial reports, focus on profitability and the degree of leverage. A company that isn’t profitable may not be a long-term player, and too much debt in relation to stockholder equity can be a red flag. Also, read the notes to financial statements. They can provide an inside look at factors such as litigation, merger activity, unfunded benefit obligations, or other financial transactions that could be disruptive to the business.

Also ask for a list of major customers, and inquire about the dollar volume of sales for the largest customers. Determine if sales are concentrated among only a few customers, and whether or not the loss of any one customer could have an impact on the company’s ability to continue servicing all customers.

Credit Check

When you look at a 3PL’s credit risks, check with independent sources including credit reporting agencies such as Dun & Bradstreet, and rating agencies such as Moody’s and Standard & Poor’s. The credit agencies should also have information on outstanding liens and claims. Evaluate whether liens and claims are factors of normally secured credit, or a result of unpaid vendors.

Vendor ratings for payment history are also often reported to these agencies. Be careful not to rely too much on payment history alone, because it may be outdated and often contains errors or omissions. You can also do a public records search for outstanding items such as liens or bankruptcies.

Strong cash flow is the most important indicator of financial health. The Statement of Cash Flows is a key financial document that reveals the level of cash the company generates. Review that statement to determine whether the 3PL has sufficient cash flow to invest in customer needs or support services, such as information technology and engineering.

The Statement of Cash Flows will also show the level of capital spending, financing activity, and large transactions that occurred during the period. Look for items that may raise questions about the 3PL’s stability.

Some service providers have a pattern of acquisitions that creates a negative impact on financial resources. Acquisitions are often reported in news releases, on a company’s Web site, or can be located through an Internet search. Examine the size, funding source, and business rationale for acquisitions. A large acquisition that requires significant outside debt funding can be a distraction and a source of financial instability.

If you are doing an analysis of a privately owned company, seek out information from the 3PL, its Web site and news releases, and basic Internet searches. You can also ask a privately owned 3PL company to respond to specific questions regarding its financial health.

Complete your review of the service provider’s financial health before you sign or renew contracts. Afterward, review financial conditions annually. If situations such as a change in control of the service provider arise, consider doing a more frequent review.

Assessing your partner’s preparedness

Supply chain disruptions significantly affect your bottom line, so you should know how your 3PL partner is positioned to deal with them on the logistics side.

Prepare some probing questions before finalizing the agreement. Ask about internal planning for disaster preparedness, labor shortages/stoppages, technology outages, weather-related transportation disruptions, and other risks particular to your product line.

Also ask what kind of investments the 3PL has been making—and plans to make—in technology and equipment innovation, as well as employee training. Is it able to keep up with competitors? How disruptive will any changes be to daily operations? And, how will the 3PL pay for innovation and measure its effectiveness?

While many factors come into play when choosing a 3PL, don’t overlook the importance of choosing a financially stable partner. Unhealthy logistics partners could damage your business and negatively impact your customers.

A 3PL that is not financially stable may be focused on its own economic situation rather than helping you improve your business. Financially healthy partners should have the resources to invest in you as a customer, and in their own operational capabilities, to provide the customer service you require.

Dwight Crawley is the chief financial officer of Kenco, a Tennessee-based third-party logistics company.

Outsourcing Spending Patterns Persist

Source: Korn/Ferry Institute, 2013 Third-Party Logistics Study

Financial Checklist for 3PL Relationships

Before you sign on the dotted line with a new partner, it is important to do a thorough review of the 3PL’s financial history and outlook. Here are key factors to evaluate:

Check

- Credit report and bank references.

- Certificates of insurance.

- Financial rating with an independent firm such as Moody’s Investors Service.

- Vendor ratings for payment history.

Track

- Financial data for the past several years.

- Potential risk of financial failure using a tool such as the “Z score” for predicting bankruptcy.

Review

- Customer base for diversity and stability.

- Private funding for impact on available cash.

- Outstanding liens or claims.

- Acquisition costs, or any factors that could overextend financial resources.

3PLs Deliver Measurable Results

Shippers worldwide report impressive results through use of 3PL services.

| Results | All regions | |||

|

|

Logistics Cost Reduction | 15% | ||

|

|

Inventory Cost Reduction | 8% | ||

|

|

Logistics Fixed Asset Reduction | 26% | ||

|

|

Order Fill Rate | Changed from | 58% | |

| Changed to | 65% | |||

|

|

Order Accuracy | Changed from | 67% | |

| Changed to | 72% | |||

Source: Korn/Ferry Institute, 2013 Third-Party Logistics Study