Quick Look at the Last Mile

Two new studies take a close look at the last mile and shed some light on the current state of this crucial logistics segment. The quick takeaway? The last mile is becoming more important for customer satisfaction, and as a result, shippers are increasing their focus on it and looking for tools to boost delivery time frames and efficiency.

Brands are responding to customer demand for faster delivery by enhancing their last-mile fulfillment options, finds a survey of more than 200 U.S. retail and supply chain leaders conducted by UPS company Roadie, a crowdsourced delivery platform. The study also examined what brands look for in an ultrafast delivery provider.

Respondents’ views on ultrafast delivery reveal three key themes:

1. Customers expect same-day delivery, and they’re willing to pay for it.

2. Same-day delivery generates an immediate, positive effect on sales.

3. Brands face challenges in implementing ultrafast last-mile delivery.

“What came through clearly in the survey responses is that organizations know they need to offer same-day delivery because there’s a lot at stake,” says Valerie Metzker, head of partnerships and enterprise sales at Roadie. “When customers want something quickly, they’ll go with the provider that can get the order to them when they need it.”

Another report, 2022 State of Last Mile Logistics, from Bringg, which also offers an online delivery platform, takes a comprehensive look at the last-mile segment. Bringg surveyed 200 logistics and transportation leaders in Europe and North America to determine where they are focusing their last-mile operations today as well as what they believe are the key challenges and priorities for 2022 and beyond.

Overall themes that emerged include:

- Connectivity is needed in order to manage last-mile delivery at scale.

- Strong last-mile and returns services can provide a competitive edge.

- Real-time visibility and automation will be an important focus.

- More efficiency is necessary to increase profitability of last-mile services.

- Better delivery experiences will help drive last-mile revenue growth.

- Logistics providers struggle with managing multiple carriers.

The study also shed light on the top pain points associated with last-mile logistics. When asked to name their biggest last-mile challenges, respondents cite the following:

- Shipper onboarding/integration (44%)

- Outsourced delivery partner/agent visibility (44%)

- Carrier and driver management (41%)

- Driver onboarding and retention (38%)

- Manual delivery scheduling (38%)

- Manual back-office operations (37%)

- Cost to deliver (23%)

- Lack of real-time order tracking and visibility (23%)

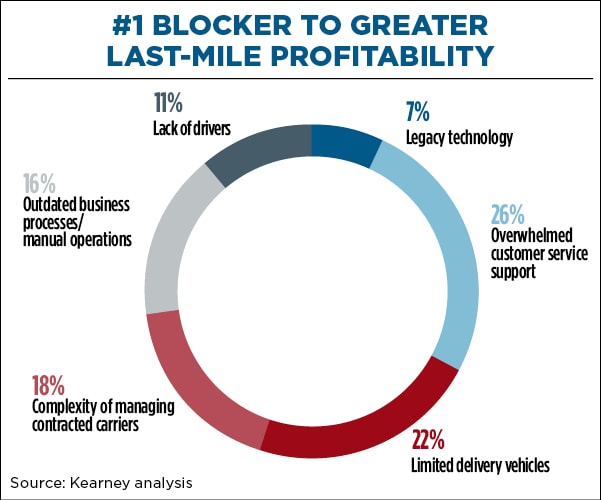

In addition, Bringg’s survey unearthed insights on what blocks companies from achieving greater last-mile profitability (see chart). The top culprits are:

- Overwhelmed customer service support (26%)

- Limited delivery vehicles (22%)

- Complexity of managing carriers (18%)

- Outdated business processes/manual operations (16%)

- Lack of drivers (11%)

- Legacy technology (7%)

Combating Supply Disruption with Digital Transformation

Finding effective ways to fight against supply chain disruptions resulting from the pandemic has been top of mind for all businesses of late. Digital transformation appears to be one of the most popular strategies for accomplishing that goal, according to a new report from international spend management company Proactis.

A survey of 1,300 senior business-decision makers in the United States and four European economies shows a new emphasis on using digital transformation. Key takeaways:

- Major U.S. businesses will invest an estimated $4.4 trillion in digital transformation in 2022 to help their businesses recover from disruption.

- Digital transformation is seen as the most effective route to improve business resilience, protect margins, and improve trading opportunities.

- The most common reasons for undergoing digital change are to create efficiencies and increase profitability.

- 8 in 10 major businesses have already digitized supply chains to tackle disruption.

- One-third of respondents (34%) identify “secure supply chains” as an area of importance for conducting business digitally, with data analytics and automation of processes also critical to create more agile and fluid supply chains that can more effectively adapt to disruption.

- On average, U.S. businesses invested $7 million in digitization in 2021 across 10 different areas of business, an investment that is higher than the total average investment across the rest of the major economies surveyed.

- Cybersecurity and privacy top the list of priorities, with 60% of major U.S. businesses saying that cybersecurity was important in the context of digital business.

Ports Open Up

Some good supply chain news for a change: Recent numbers show that congestion at U.S. ports is beginning to ease. The May 2022 monthly Port Report from Project 44 shows that congestion numbers improved in April 2022 compared to March 2022 across all U.S. ports.

U.S. ports also recorded their best month yet in March 2022, unloading more than 2.5 million TEUs, improving overall import throughput, and capitalizing on the lull.

What’s behind the improvements? The slowdown in U.S. demand coupled with the COVID lockdowns in China have led to a drop in activity.

Interestingly, the ratio of vessels berthed versus waiting is a mixed bag: The report shows that West Coast ports had more vessels berthed than waiting outside in April, while East Coast and Gulf ports experienced the opposite..

No Packaging Material? No Problem

While the supply instability for packaging material has been causing headaches for chief procurement officers (CPOs), new research from Gartner says three tactics can go a long way toward helping companies navigate the resulting rising costs, delayed deliveries, and sustainability concerns:

1. Centralize packaging specifications and build a packaging supply ecosystem: This allows CPOs better visibility and enables improvements such as harmonizing similar materials, establishing more sustainable alternatives, and fluidly switching suppliers in the event of a shortage.

2. Collaborate with suppliers: Working closely with vendors, collaboration can take the form of agreeing on suitable material substitutions, alternative production facilities, incentives, or streamlined supplier onboarding.

3. Segment packaging: Each level of packaging has its own set of risks, so CPOs must factor that into strategies to mitigate supply shortages. Segmenting packaging across the organization provides a better base for decision-making.

AI Roadblocks

Once thought of only as the stuff of sci-fi movies, artificial intelligence (AI) and machine learning (ML) have become more commonplace in the supply chain, with uses in a range of applications from manufacturing to yard management.

Many companies, however, have yet to tap into AI/ML for supply chain usage—but it is becoming more of a priority. That’s the message from research conducted by Symphony RetailAI, a provider of integrated AI-powered supply chain solutions for fast-moving consumer goods (FMCG) retailers and manufacturers, in partnership with Incisiv. The survey reveals:

- 87% of FMCG retailers have not yet taken steps to embrace AI and ML.

- Data-related initiatives—supported by AI/ML tools—are becoming a top supply chain priority: 82% of respondents say they are focusing on data-driven demand forecasting and 61% cite the need to improve master data management.

- 92% of FMCG retailers say that their inability to integrate data from multiple sources prevents them from successfully pursuing AI solutions.

- Respondents cite other roadblocks to AI: poor data quality (79%) and a lack of confidence in AI to make good recommendations (31%).

- 22% of respondents are concerned about falling behind to the competition due to a lack of an AI-based strategy.

Four Ways to Net Zero

In the quest to green the supply chain, warehouses play a pivotal role, says Mark Russo, director and head of industrial research for North America at Savills, a commercial real estate services firm.

Pointing out that there is more than 16 billion square feet of industrial property in the United States, with another 750 million square feet in the pipeline, Russo makes the case in a new report that the sheer quantity of warehouses in the United States makes the greening of the sector an essential component of achieving sustainability goals.

Those who pursue net zero emissions in their warehouse portfolios will reap business benefits as well, Russo says. Case in point? Green-friendly LEED industrial buildings significantly outperform the broader market with a 38% rent premium and vacancy rate of 1.9% (versus 4.2% for the U.S. overall), he notes.

Four other highlights from the report include:

1. Site selection is key. Choosing to occupy environmentally friendly buildings in optimal locations near the workforce to limit transportation emissions are two major actions firms can take toward reaching net zero.

2. For ground-up warehouse developments, designing sustainably should be paramount. Construction materials, lighting, and landscaping all impact emissions.

3. Pursuing LEED certification should be more commonplace. The percentage of industrial inventory that is currently certified is relatively small, yet LEED industrial buildings significantly outperform the broader market in terms of rent premiums and vacancy rates.

4. Nearly 30% of LEED-certified industrial properties are located near the central business district in the 30 largest U.S. metros. These properties, which represent green buildings located close to city centers with dense populations, offer the greatest potential to reduce carbon emissions for logistics operations, Russo notes.