Florida: Logistics & Distribution—The Future is Here

Florida’s state-of-the-art seaports and airports, and strong highway and rail networks, have helped establish a strong and growing logistics sector.

Florida often calls to mind sandy beaches, lush orange groves, and one cheerful mouse with big ears. But for supply chain professionals, Florida’s robust logistics infrastructure is the main attraction.

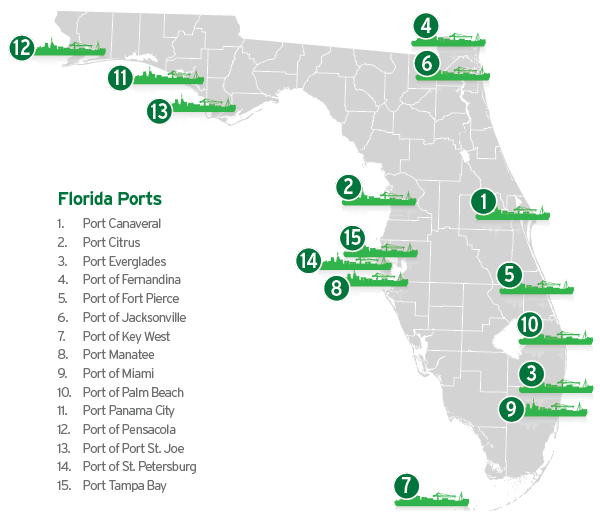

The state is home to 19 commercial service airports, 15 deep seawater ports, more than 2,700 miles of railroad, and 12,000-plus miles of state highways, according to Florida: Made for Trade, a Florida Chamber Foundation, the Florida Department of Transportation, and Bank of America Merrill Lynch report.

Shippers are putting the infrastructure to good use. More than $142 billion in merchandise trade flowed through Florida’s airports and seaports in 2016, making the state one of the world’s leaders in international trade, according to Enterprise Florida, the state’s primary economic development group. Florida is home to about 60,000 exporting businesses, or one-fifth of all U.S. exporters, says Tim Vanderhoof, senior vice president of business with Enterprise Florida.

“The state’s proximity and cultural ties to Latin America provide an added advantage, making Florida a natural hub for companies moving goods to or from the region,” says Chris Mangos, director of marketing with Miami-Dade Aviation Department, which owns and operates Miami International Airport.

About one-quarter of Floridians are Hispanic or Latino, according to 2016 U.S. Census Bureau estimates. Approximately 40 percent of all U.S. exports to Latin and South America pass through Florida, Mangos says.

Florida’s infrastructure strength builds on its overall business climate. “Florida often is known as a retirement and tourist area,” Vanderhoof says. “What surprises many is the strong business climate.” As of 2014, Florida was one of 13 states to hold a Triple A credit rating—the highest available—from Standard & Poors, according to the Council of State Governments.

Serious About Business

Many business leaders appreciate the 5.5-percent corporate income tax rate, says Doug Wheeler, president and chief executive officer with Florida Ports Council. Of the 44 states that levy corporate income taxes, Florida’s is among the lowest, according to the Tax Foundation. Moreover, Floridians pay no individual state income tax.

“Our dollars stretch much further in Florida, as compared to other states, thanks to the competitive tax structure and overall business-friendly environment,” says Pat O’Malley, vice president, chief commercial and marketing officer with Landstar System, Inc., an asset-light provider of integrated transportation management solutions. He notes that Landstar could locate its headquarters anywhere, yet chose the Sunshine State. “It’s pro-business and has great weather,” he says.

Some of the nation’s top educational institutions call Florida home. The University of Florida in Gainesville ranked 10th on Time magazine’s list of the 50 best public universities. Companies looking for up-and-coming logistics professionals can turn to the logistics program at the University of North Florida in Jacksonville. “It provides the community with professionally trained, motivated logistics students,” O’Malley says.

State leaders have identified eight industries on which to focus their development efforts, Vanderhoof says. These include aviation, defense and homeland security, financial, manufacturing, life sciences, and logistics and distribution. The goal is to ensure a diverse commercial base and reduce dependence on any one industry sector.

Given the state’s many assets, it’s not surprising that more people, in addition to businesses, find Florida appealing. It’s now the third-largest state in the United States by population, and annually hosts 100 million visitors from out of state, says Bradley Hall, senior vice president and chief commercial officer with Florida East Coast Railway.

Logistics Infrastructure

Over the past several years, state and local leaders in Florida have invested heavily in its infrastructure, including seaports, airports, and highways. “Florida is a pro-transportation state,” says Tim Nolan, president of TOTE Maritime Puerto Rico.

A case in point is a $6.4-billion capital improvement program at Miami International Airport, which has added more than 4 million square feet of terminal space, among other improvements.

Another is PortMiami’s “Deep Dredge Project,” which increased channel depth to about 50 feet, allowing it to accommodate super-sized vessels.

“The state legislature and governor (Rick Scott) have been tremendous champions of infrastructure investments that will prepare Florida for the opportunities in cargo growth resulting from the Panama Canal expansion,” Wheeler says.

The expanded Panama Canal, which opened in 2016, increases the waterway’s capacity to accommodate larger vessels. The canal links the Atlantic and Pacific oceans, allowing ships to avoid sailing around the southern tip of South America, which can add about 5,000 miles to their voyages.

Because of these investments, even cargo that starts in Miami, at the southern tip of the state, can reach about 60 percent of the U.S. population in no more than four days. “With the PortMiami Tunnel, for instance, which provides direct access between the seaport and interstate highways 395 and 95, containers can move from the port to the highway and all the way to New Jersey without stopping,” Wheeler says.

Transit times can be even shorter for cargo that begins its journey at any of the state’s ports farther north.

Conventional wisdom used to hold that Florida is a peninsula state at the end of the United States, and thus of little use from a logistics perspective, Wheeler says. These infrastructure improvements render that perception invalid.

Indeed, in 2014, the U.S. Chamber of Commerce ranked Florida’s infrastructure second best in the country, Vanderhoof says.

Public-Private Partnerships

Both businesses that already operate within Florida and those considering expanding to the state can turn to Enterprise Florida (EFI), a public-private partnership between Florida’s business and government leaders, for assistance. “We help everyone from small businesses to Fortune 100 companies,” Vanderhoof says.

The assistance is tailored to each company, he says. EFI has worked with organizations to identify sites that fit their location criteria, whether they require a certain square footage, building type, or distance from a port or rail network. The EFI team also can analyze labor statistics, helping to ensure a company can access the employee base it will need to start, maintain, and grow its operations. It also can help businesses navigate state and local permitting and licensing processes. “We help them hit the ground running,” Vanderhoof says.

While economic development traditionally has focused on retaining businesses already within a state or region—and this remains a critical goal—many state governments, including Florida’s, have realized “that like anything else, they have to sell their states,” Vanderhoof says. More industry leads to a larger tax base and typically to a more diversified industrial base. That benefits both businesses and the residents who work for them.

Another nonprofit, the Florida Ports Council (FPC), acts as a collective voice for the 15 public seaports within the state. It advocates for them at the state and federal levels on issues including transportation, trade, and economic development, Wheeler says.

Florida’s 15 public seaports moved more than $50 billion of containerized cargo between 2015 and 2016, along with 15.5 million cruise passengers, the Florida Ports Council reports. The ports handle trade coming from or heading to more than 200 countries.

What’s more, the ports are planning to invest $2.8 billion in improvements over the next five years, Wheeler says. This will allow them to leverage the opportunities resulting from realigning global trade routes. Among other shifts, the Panama Canal expansion is expected to increase the volume of trade heading from Asia directly to U.S. East Coast markets, according to the Florida: Made for Trade report.

These investments come on top of more than $1 billion already put to work over the past six to seven years. Along with the work at PortMiami, a federal project to deepen the channel at the Port of Jacksonville is set to begin construction by early 2018. Similarly, at Port Everglades, work to deepen the main navigational channels, the entrance channel, and parts of the Intracoastal Waterway is forecast to be completed between 2021 and 2024.

The ports also are adding larger cranes that can more efficiently load and unload the larger ships. In 2013, PortMiami added four Super Post-Panamax cranes that can handle megaships with cargo capacities of more than 10,000 twenty-foot equivalents, or TEUs.

“We’re making many investments to ensure we capture the new opportunities heading our way, and continue to efficiently and cost-effectively work with the ships already using our ports,” Wheeler says.

Florida’s ports have undertaken numerous initiatives to ensure they operate sustainably and minimize their impact on the environment, Wheeler says. For instance, the sand and dirt dredged up to deepen PortMiami has been repurposed for use at area beaches and to create island bird sanctuaries. “We work to find ways to have a positive, secondary result,” Wheeler says.

Since 2014, total cargo tonnage coming through Florida’s ports has increased. “We’ve made the investments and we’re seeing results,” Wheeler says.

Along with the capital investments they’re making, Florida’s ports continue to enhance their operations. Earlier in 2017, Port Canaveral in Cape Canaveral became an official participant in the Southeast United States In-transit Cold Treatment Pilot Program, which is run by the U.S. Department of Agriculture, Animal and Plant Health Inspection Service.

Historically, some fruit products coming from warmer regions of the world could only be shipped to northern ports in the United States. The colder weather would kill any fruit flies or other pests accompanying the shipment. This route was used even for products ultimately headed for Florida or other southeastern states. This process was expensive and extended transit times.

Handling a Diverse Array of Cargo

Products arriving under the Cold Treatment Pilot Program must follow the protocol outlined by the USDA, which requires the containers’ temperature to be controlled and tracked, among other steps. In return, many agricultural products that originate in warmer climates can travel directly to southern ports. The new program means “the produce gets to market sooner and at less cost,” Wheeler says.

Port Canaveral, while often known as the second-largest cruise port in the world, also encompasses a free-trade zone and handles a diverse array of cargo, including containers, automobiles, bulk commodities, and petroleum.

“We’re uniquely positioned in Central Florida,” says chief executive officer Captain John Murray. The port houses two deepwater container and multi-purpose cargo berths, two ship-to-shore cranes, and a 40-metric-ton mobile harbor crane.

To date, central Florida hasn’t been a large cargo market, Murray notes. That’s changing. Location plays a role: any part of the state is accessible by highway within four hours, he notes. More than 18 million people are within about a three-hour drive.

Central Florida also is one of the largest auto rental markets in the country, and many of the cars come in new from overseas manufacturers. Automobiles coming through Port Canaveral can be consigned and delivered to dealers in record time, due to the processing facility’s location right on the port, which allows processing to be completed before the cars are distributed. In fact, many auto manufacturers can move two or three loads of cars from their ships in one day. “At other ports, they’re sometimes lucky to get one load off,” Murray says.

Not surprisingly, this business is growing, Murray notes. Port Canaveral has begun working with one major auto original equipment manufacturer located in Mexico, and will begin bringing in cars from a plant located in Asia later in 2017.

Port Canaveral also is working with companies in the space exploration field. In July 2017, the port hosted the official opening of a 24,000-square-foot manufacturing facility for RUAG Space USA, a Swiss firm specializing in aerospace components. The facility is located within the new Orlando-Port Canaveral Logistics Park.

The port also leases land to SpaceX, the commercial rocket company, for a rocket refurbishment center. The Logistics Park offers more than 230,000 square feet of warehouse and distribution space to meet the current and future logistics needs of the businesses operating at Port Canaveral.

Port Canaveral will focus on being a strong niche operator for small container vessels. “In a hub-and-spoke model, we’re ideal for feeder operations,” Murray says.

Location, Location, Location

About 160 miles up the Florida coast from Port Canaveral, JAXPORT in Jacksonville is the largest container port in Florida, says Roy Schleicher, executive vice president and chief commercial officer. In the year ending September 2016, more than 968,000 TEUs moved through JAXPORT, up about 3.3 percent from the previous year. When containers moving through the harbor’s private users are added, Jacksonville’s total jumps to more than 1.2 million TEUs.

The Asian container trade continues to drive growth, Schleicher says, noting that it jumped about 19 percent in 2016. The volume of non-containerized cargo grew 22 percent over the previous year.

Several attributes attract shippers to JAXPORT, Schleicher says. One is location. The port is located near interstate highways 95, 10, and 75. “There’s easy access and little congestion. Customers can quickly get their cargo in and out of the port,” he says.

JAXPORT is the only port on the East Coast at which vessels can refuel with liquid natural gas, or LNG. “We’re pioneers in the use of LNG as a maritime fuel,” Schleicher says.

In addition to its highway connections, JAXPORT is connected to several rail networks. “Anything that heads to south Florida by rail comes through JAXPORT,” Schleicher says.

Port management continues to invest in improvements that currently total about $600 million. One major undertaking is the deepening of the river from 40 to 47 feet so that it can accommodate large ships. The leadership also is investing in new cranes, including larger ones that can handle Post-Panamax vessels, as well as new docks.

About one year ago, JAXPORT opened an intermodal container transfer facility, or ICTF. Directly transferring cargo between vessels and trains speeds cargo transport, Schleicher says.

These features have helped attract to the port the three major shipping alliances going to and from Asia. “All three call our port home,” Schleicher says.

The port’s trade is almost evenly balanced between imports and exports, Schleicher says. That means ocean carriers that bring in, say, 50 full containers often can ship out with 50 full containers, minimizing the number of voyages in which they’re not carrying cargo.

JAXPORT’s award-winning customer service also sets it apart. “We help you come and help you stay successful,” Schleicher says.

The Grimes Companies, a full-service third-party logistics provider, has worked with JAXPORT for decades, says Ike Sherlock, executive vice president. “JAXPORT’s huge investment in infrastructure allows Grimes to help its customers capitalize on the growth in the Asian container business,” he says.

In addition to the Panama Canal expansion, the growth has been driven by shippers’ growing preference to move goods headed for the East Coast entirely by ship. Previously, many shipments would stop at the West Coast and then travel via truck across the country. “JAXPORT is a great strike zone for these shipments,” Sherlock says.

“Jacksonville is a logistics place,” he adds. In addition to the work at the port, the Florida Department of Transportation has been preparing the roads for the additional traffic, and the rail networks have been building intermodal container yards. “Everyone is working hard toward the same goal,” he says.

Handling Greater Cargo Volumes

Some 30 years ago, TOTE Maritime Puerto Rico started as a tug and barge operator, says Nolan. Today, the Jacksonville-based firm focuses on providing service from the mainland United States to Puerto Rico. Its ships are designed to efficiently accommodate the 53-foot containers used on the island.

TOTE Maritime Puerto Rico is currently the only provider with two vessels providing service between the U.S. mainland and Puerto Rico. Each can make the trip in fewer than three days and is powered by dual-fuel engines, utilizing liquid natural gas as the fuel source.

“They’re a first of their kind,” Nolan says. TOTE Maritime engaged the Coast Guard and local fire departments to enact the most efficient and safe LNG fueling operation. The company’s fleet is one of the youngest in the business, he adds.

In 2018, TOTE Maritime plans to introduce an LNG bunker barge. This will enable its ships to re-fuel as traditionally done by a bunker barge, leaving the land side free for ship operations.

Based on its strategic plan, in 2014 TOTE Maritime started investing in terminal operations, infrastructure, assets, and systems, in order to deliver the safest, most efficient, and optimal service within the trade. As part of the ongoing execution of TOTE Maritime’s strategic plan, additional upgrades are underway in San Juan, Nolan says.

With the new systems in place, TOTE Maritime is handling greater cargo volumes more efficiently while delivering high-quality service. “Various key performance indicators and safety measurements have significantly improved gate transaction times, terminal turn times, invoicing accuracy, automated bookings, and call hold times. “Most importantly, from a safety perspective, they’ve reduced lost time and recordable incidents,” Nolan notes.

“We pride ourselves on delivering an unparalleled customer experience,” Nolan says, noting that TOTE Maritime employees proactively communicate with customers and work tirelessly to meet their needs.

Aqua Gulf Transport, a TOTE Maritime client, is the largest third-party logistics provider to Puerto Rico and other islands in the Caribbean. “Jacksonville is the gateway to Puerto Rico,” says President Sergio Sandrin.

Sandrin notes that 50 years ago, most large manufacturing and production was concentrated in the northeastern United States. Much of it has since moved south. “Everyone is sailing from Jacksonville,” he says. Aqua Gulf operates from a 62,000-square-foot warehouse near JAXPORT. Its customers cross industries, although many are from the food, supermarket, and distribution sectors

While the state’s proximity is an advantage for those moving goods between the U.S. mainland and the Caribbean, the infrastructure within Florida also plays a big role. “It’s an easy state in which to do business,” Sandrin says.

To be sure, severe storms and hurricanes can present challenges, especially on Florida’s east coast. Weather can delay ships and create supply chain bottlenecks. Because many companies in Puerto Rico operate on just-in-time schedules, delays can mean empty store shelves.

As soon as severe weather hits, Aqua Gulf management can switch operations to its locations in Puerto Rico or New Jersey. And as a non-vessel operator, Aqua Gulf is carrier-neutral. “We can shift cargo to a carrier that’s not as impacted by the weather,” Sandrin says.

Aqua Gulf also works closely with TOTE. “Our teams work together to solve problems and provide efficient and fast transportation to customers,” Sandrin says.

Vision for Growth

Located on Florida’s west coast, Port Tampa Bay (PTB) is the state’s largest. More than 37 million tons of cargo flow through the port each year, or about one-third of all cargo moving in and out of the state.

The port’s leadership isn’t sitting still, however. “We have a vision for growth,” says Raul Alfonso, executive vice president and chief commercial officer. For many years, the port focused on bulk cargo, including fuel, petroleum, fertilizer, and other commodities. “We’ve been an energy hub for Central Florida,” Alfonso says.

PTB will continue to grow its bulk business. At the same time, management “is focused on becoming a highly efficient logistics and supply chain alternative for consumer and food products for the state, while also expanding our export cargo base,” Alfonso says.

He points out that central Florida is home to about 9 million people and 65 million visitors each year. Moreover, the Florida Department of Transportation expects the region’s population to jump by more than 1 million by 2020.

“With e-commerce, everyone wants to be closer to consumers,” Alfonso notes. “That’s what we offer.” Both Amazon and Walmart have distribution centers within about 30 miles of Port Tampa Bay. Shippers with cargo headed to Central Florida can save about $670 per container load by using Port Tampa Bay, rather than ports located several hundred miles away, according to PTB research. “It’s a significant savings,” Alfonso says.

To attract this business, the port is building a 135,000-square-foot on-dock cold storage facility that’s scheduled to open later in 2017. It invested in two Post-Panamax cranes that can handle 9,000-TEU container ships. It’s developing railway infrastructure to handle on-dock and near-dock services. The sheer size of the port—it spans about 5,000 acres—also provides excellent long-term expansion capabilities, Alfonso notes.

In addition, Port Tampa Bay is working closely with its terminal operators, 3PLs, rail, and other partners to continue to enhance port operations, trucking and rail capabilities, and warehouse and distribution services, Alfonso notes. In 2016, for instance, Tampa Tank and Florida Structural Steel broke ground on an $18-million expansion plan at Port Redwing, a part of PTB. This will become home to manufacturing and distribution businesses.

PTB crane operators can move about 40 containers per hour, well above the industry average of 30, Alfonso notes. Because of the easy highway access and on-dock rail facilities, many truck drivers working at PTB can fit in three to four turnarounds per day; at other ports, they might complete one.

These initiatives are part of the Port Tampa Bay Master Plan, “Vision 2030”, unveiled in December 2016. “We are passionate about this master plan and its ability to deliver the port’s mission for growing economic impact and sustainable jobs through international trade,” says Alfonso. “We know we are a better alternative for many cargo commodities and we are building toward that potential for the future. That is why our new branding for the port contains the tagline ‘Re-Route Your Thinking.’ We need cargo owners and carriers to think about our capabilities in an entirely new way.”

Air Cargo City

To be sure, not all cargo arrives in Florida via water. Miami International Airport (MIA) is the top airport in the United States for international cargo, and 11th worldwide. In 2016, it handled 2.1 million tons of cargo; of that, nearly 80 percent was international.

“MIA is the leading gateway to the Latin American and Caribbean region, both in terms of cargo and passengers,” Mangos says. The airport handles 83 percent of all air imports and 79 percent of air exports between the United States and Latin America and the Caribbean.

In 2016, 44.6 million passengers, nearly half of them international, came through the airport. It’s the third-largest airport in the United States for international passengers.

While the overall air cargo market had been stagnant for several years, it grew 4.8 percent at MIA during the first half of 2017, Mangos says. He attributes this to significant growth for both Asian and Latin American carriers. For instance, volume at Korean Air jumped more than 13 percent, and 14.3 percent at Asiana. Volumes from Latin America carriers rose even more dramatically, jumping 62 percent at Atlas and 86 percent at KFCargo.

“Other carriers also showed strong, positive numbers after an extended flat growth period,” Mangos says.

Several factors drive this growth, including improving Latin American economies, increased production in Asia, and the growth of e-commerce domestically.

MIA continues to expand its cargo service offerings. It recently was designated a Pharma Hub by the International Air Transportation Association (IATA), making it the first airport in the United States to earn this designation. This recognizes MIA’s success in engaging the local cargo community in the IATA Center of Excellence for Independent Validators (CEIV) Pharma Certification Program, which prepares logistics companies to become experts at properly handling sensitive pharma products shipped by air.

Not surprisingly, the pharma trade at MIA jumped 140 percent between 2010 and 2016. It now represents $4.4 billion in annual trade, according to MIA.

As a global airport, MIA is a city within a city, Mangos says. It spans more than 7 million square feet, and encompasses 18 cargo terminals that serve more than 100 airlines, or more than any other U.S. airport.

“All this requires continuous, round-the-clock orchestration for the smooth and efficient movement of people, goods, airplanes, and vehicles,” Mangos says. A thriving maintenance, repair, and overhaul (MRO) department, with more than 38,000 airport employees, care for the dozens of airlines that need everything from minor fixes to complete overhauls.

Also based in Miami is Freight Logistics, a forward-thinking, transportation and logistics solutions provider. Chief Executive Officer Gabriel de Godoy founded the company in 2001 in San Jose, California, and relocated it to Miami in 2007.

“I relocated it specifically because Miami is a gateway into Latin America,” he says.

Many Freight Logistics customers—ranging from small businesses to multinational enterprises—turn to the company to help with integrated logistics and freight forwarding solutions into and out of Latin America. “We work globally but our focus is Latin America,” de Godoy says.

Latin American Gateway

A large percentage of U.S. flights bound for Latin America depart from Miami, de Godoy says. When the company was based in California, it often ended up trucking products across the country before shipping them south. “Here, most major airlines have daily service to Latin America,” he says.

Because Freight Logistics started in Silicon Valley, its strength has been in handling sensitive, high-technology products, de Godoy says. Due to this specialization, the majority of shipments travel via air freight to Latin America. “We’ve developed proprietary software systems designed from the ground up to service the unique demands of the high-tech market,” he says.

Freight Logistics also helps customers navigate the customs regulations and idiosyncrasies of many Latin American countries. For instance, different states within Brazil offer varying incentives to lure imports and to generate business.

“We often spend quite a bit of time with a prospective customer to understand their business in order to design and implement solutions we feel will best fit their needs and be the best model for them,” de Godoy says.

He notes that the firm can’t substitute for the advice and guidance of tax attorneys, but often can help guide customers based on the expertise it has gained over 20 years of doing business in Latin America.

Freight Logistics tailors each solution to the customer. “We don’t just offer standard options,” de Godoy says. “We listen to customers, their wants and needs, and try to customize a solution unique to them.” When a multinational distribution customer decided it no longer wanted to run its own warehouse in Miami, de Godoy asked about the pain points, the inefficiencies, and the tasks that took management away from more important responsibilities. It then provided ideas combined with technology that addressed these challenges.

INNOVIEW, Freight Logistics’ proprietary integrated-technology platform, is the brain behind its operations and has been internally developed. “That provides a great deal of flexibility,” de Godoy says, and allows his team to truly tailor the solutions they offer.

Freight Logistics also has made significant investments in business intelligence reporting, de Godoy says. Its solutions measure and report on key performance indicators, such as the time products have spent in inventory and the time required to fill orders, among other measures. Many reports are available in real time and can be accessed from anywhere.

“Customers dictate what’s important to them and we build specific business intelligence reports to meet those requirements,” he says.

Florida East Coast (FEC) Railway operates the 351 miles of track along the east coast of Florida connecting Miami to Jacksonville. Its multiple train departures each day, with various cutoff and arrival times, give shippers fast, flexible access to markets within Florida and throughout the Southeastern United States.

Strategic Partnerships Increase Efficiencies

FEC Railway’s exclusive access to many of South Florida’s ports, strategic multi-modal partnerships, and interchanges with Class I railroads in Jacksonville, allow it to seamlessly deliver goods and products to 70 percent of the U.S. population within one to four days.

“FEC Railway provides cost-effective, reliable, and sustainable end-to-end logistics solutions into and out of Florida,” says Bradley Hall, senior vice president and chief commercial officer with the railway.

The trains move most carload commodities, including aggregates, automobiles, lumber, farm products, food and food products, machinery, pulp and paper, ethanol, bulk chemicals, stone, clay, and glass. They also transport international and domestic containerized intermodal freight. FEC’s Highway Services drayage operation and its regional trucking carrier, Raven Transport, provide over-the-road and dedicated haulage services beyond the rail.

FEC’s Intermodal Container Transfer Facility (ICTF) provides near-dock rail access to Port Everglades. The facility spans 43 acres and has an annual intermodal capacity of 450,000 lifts.

“The ICTF provides a cost-feasible rail alternative to water-to-truck hinterland distribution to southeastern markets,” Hall says.

A Complete Florida Solution

Shippers can use a Port Everglades carrier to drop cargo in south Florida, move that cargo to an FEC train headed for Jacksonville, and then transfer to another rail network to land in Atlanta or Charlotte more quickly and less expensively than going directly into Savannah or Charleston.

Similarly, FEC’s exclusive on-dock rail service at PortMiami allows it to provide efficient service, minimizing moves and providing a more efficient connection to the national rail networks. “With on-dock intermodal rail service, FEC Railway allows ocean carriers to transition their international freight into fewer domestic containers, and quickly reach inland markets,” Hall says.

Because of its multiple daily train departures, FEC is able to provide scheduled and reliable flexible service options, whether customers are seeking domestic or international intermodal services, or ramp-to-ramp or door-to-door options, Hall notes. Shippers are able to use their own containers and trailers, or FEC-provided equipment.

Florida East Coast Railway has invested in infrastructure to support multi-modal shipping and global trade into and out of South Florida and is positioned to handle the growth expected throughout Latin American, Caribbean, and Asian markets from the Panama Canal expansion.

The railroad is working to double-track the majority of its track from Jacksonville to Miami, which will allow for even more scheduled train runs. In November 2015, FEC began converting its fleet so it can run on sustainable liquefied natural gas, a cleaner and more efficient fuel source than diesel.

Over the past several years, FEC has purchased two dozen new locomotives, 50 refrigerated trailers, and 500 53-foot containers. These provide more opportunities to transload import cargo from ocean containers to domestic containers for inland rail transport. “More domestic containers move north as loads, instead of empties,” Hall says.

“With infrastructure enhancements, added capacity, truck-like delivery speeds and our partnerships with the south Florida ports, we are well positioned for growth today and in the future,” Hall says.

Finding the Optimal Transport Mode

When shippers need to move their products via truck, many turn to Landstar System, Inc. Landstar provides integrated transportation management solutions to customers across the globe, using its network of agents, third-party capacity owners, and employees, says O’Malley.

Landstar moves freight by all modes of transportation, although truckloads account for about 93 percent of its revenue. As an asset-light company, Landstar partners with more than 1,100 agents and 9,000 owner-operators who work as independent business owners. “We believe in the power of the small business owner,” O’Malley says.

Because Landstar’s agents and owner-operators effectively run their own small businesses, they have every incentive to make decisions that benefit both their operations and the entire system. Landstar supports them with technology, access to shipments, and fuel discounts, among other benefits.

“Having such an extensive organization means we have the scale, systems and support to ensure shipments are delivered on time and safely,” O’Malley says. The company and its agents and owner-operators collaborate with clients to evaluate different transportation modes and identify the optimal way to transport each shipment or series of shipments.

For instance, if a manufacturer produces more products than anticipated for its existing supply chain, Landstar can work with its network of agents and owner-operators to tailor a solution that will move the goods in question in a timely, cost-effective manner.

Among other products, Landstar trucks handle automotive and building products, metals, chemicals, foodstuffs, heavy machinery, retail, electronics, ammunition and explosives, and military equipment.

Some loads contain more unique and sensitive products, however. Michael Bauer, Landstar owner-operator, recently moved artifacts from World War II from the United States Air Force Airmen Memorial Museum in Suitland, Maryland to Lackland Air Force Base in Texas. The items will be stored while plans are completed for a new, expanded history museum slated for San Antonio.

“We never left the trailer with this load,” he says. “You don’t take chances with that kind of freight.”

Landstar agent Fred Otterbein coordinated the move of more than 13,000 Civil War artifacts and cannons from Savannah, Georgia to Texas A&M University, where they’ll be researched. The items had been unearthed by the U.S. Army Corps of Engineers when they were dredging the Savannah River. It was determined that they were from the CSS Georgia, an ironclad from the Civil War era.

“We do a lot of specialized project loads,” says Otterbein. “Our agency had to coordinate all the moves with the U.S. Coast Guard. Things were literally being pulled out of the water and put directly onto trucks for transport.”

One-Stop Solution

From its start in 1924 in Houma, Louisiana, when Louis Saia Sr. decided to remove the rear seats from the family car and use it to deliver produce, Saia, Inc. now provides mostly LTL services to 38 states as well as Canada, Puerto Rico, and Mexico. The company operates from 152 terminals and its 9,000 employees move about 25,000 shipments every day, with an average haul length of slightly less than 800 miles.

Saia handles just about all types of manufactured, grocery, and retail products, other than refrigerated goods, says Corey Thompson, vice president, Eastern operations. It also offers guaranteed and expedited services. Through its operating service groups, Saia LTL Freight, Saia Logistics Services, and LinkEx, Saia customers can engage a single entity to manage their freight brokerage, pickup, warehousing, and delivery needs, and other transportation functions, down to the final mile.

“We’re a premium service provider, and that’s driven by the quality of people we hire,” Thompson says. He notes that everyone at Saia, from drivers to dock employees to office staff, work hard to meet the needs of the company’s customers. Saia implemented a “Quality Matters More” campaign to ensure its employees are providing superior service. Over the past several years, Saia has invested $400 million in tractors, trailers, and other new equipment.

One example where Saia employees go above and beyond is with a client that ships stacks of school books within Florida. Not surprisingly, summer is this client’s busiest time of year. However, during the summer months, few schools are staffed with employees who can receive and store the books.

“Our drivers take great pride in making sure that we move the books to where the school wants them, without having to rely on their own staff,” Thompson explains. Drivers often load the books by hand onto a dolly, move them into the school, and place them in a storage area or classroom where they are safe until they’re used for the school year—all without having to involve office or maintenance personnel.

Earlier in 2017, Saia opened four terminals in the Northeast—three are in Pennsylvania and one in New Jersey. Additionally, the company partnered with TST Overland Express, the first Canadian carrier to provide cross-border LTL service, which it started in 1952. Together, the two companies offer shippers extensive LTL experience.

Later in 2017, Saia will open a terminal in Laurel, Maryland, which will service Delaware, Maryland, and northern Virginia. Shippers with cargo heading from Florida to the northeastern United States or Canada now have even more options.

Seaboard Marine, a regional ocean carrier, offers some of the shortest and most frequent transit to and from destinations in the Caribbean Basin, and Central and South America. “Seaboard Marine’s trademark is the personalized approach and strong business relations with the trade and logistics community forged over 35 years of providing consistent, high-quality service to the markets we serve,” says Chris Concepcion, marketing manager with the Miami-based company.

Enhancing Services

The company works with a variety of companies and products in each market. “If it trades in the Western Hemisphere, we’re here to carry it,” Concepcion says.

For example, Seaboard Marine serves Trinidad with two southbound weekly sailings from PortMiami. The island imports electronics, automobiles, food-stuffs, and construction materials, among other products from the United States. Back in the United States, Seaboard Marine works with anyone from brick-and-mortar retailers to perishable product importers.

Seaboard Marine continues to enhance the services it has been providing for several decades. In July 2017, management announced new direct, weekly service between PortMiami, Peru, and Ecuador. “This is important because Seaboard Marine is now the fastest carrier to and from Ecuador, Peru, and South Florida,” Concepcion says. “This direct, weekly service is ideal for time-sensitive refrigerated cargo imported to the United States from those markets.”

In August 2017, Seaboard Marine began offering two weekly sailings to Costa Rica. The company will now have the fastest transit times in the region, with the most frequent sailings.

In March 2017, Seaboard Marine completed construction on a new perishable cargo handling facility to help manage delicate refrigerated cargo. If not administered properly, inspections can expose temperature-controlled cargo to potential temperature changes.

“Seaboard Marine’s new cold chamber facility eliminates this threat, and provides customers with temperature-controlled transfer capabilities when required,” Concepcion says. The company has 432 permanent reefer plugs at its 85-acre terminal at PortMiami to support both import and export refrigerated containers.

Also in 2017, management added more than 1,000 new energy-efficient refrigerated units to its fleet. MCI, the manufacturer of the containers, uses construction processes that minimize the amount of material consumed while also optimizing structural strength. This makes the units both energy efficient and repair friendly.

Strong and Growing Logistics Sector

In late 2016 and early 2017, Seaboard Marine’s terminals at Miami and Houston were certified by U.S. Customs and Border Protection (CBP) as part of its new Marine Port Terminal Operator (MPTO) designation, known as the AQUA Lane program. This program allows Seaboard Marine to apply for Advanced Qualified Unlading Approval, so its vessels and cargo can be pre-cleared by CBP before the ships arrive.

Under AQUA Lane authority, the PortMiami terminal and Jacintoport terminal in Houston can begin discharging and loading containers the moment the vessel reaches the terminal.

“We have focused on offering personalized service since we began in 1983,” Concepcion says. For instance, Seaboard Marine works closely with importers and customs brokers before a vessel’s arrival to expedite the clearance process. “Our operations and customer service are unmatched,” he adds.

Florida’s many state-of-the-art transportation networks have helped establish a strong and growing logistics sector. “Many people who don’t live in Florida think it’s all vacation spots in Miami or Orlando,” O’Malley says. “One of the little known facts is the amount of commerce done here.”

Florida’s 15 seaports are positioned to drive growth, expand imports and exports, and enhance value-added services that support global businesses.

Weather Report

For all companies operating in the southeastern United States, weather extremes can be a concern. “We work hard to balance taking care of our customers while also ensuring a safe environment for our employees,” says Corey Thompson of Saia. “What is most important is making sure you stay close to customers, communicate your plans, and provide follow-up.”

The potential for severe weather, including hurricanes, tends to be top of mind for many businesses considering Florida as a base for operations. To be sure, it’s a serious concern. At the same time, it’s usually possible to prepare for these events. “We can get a good idea of when and where a storm will hit,” Vanderhoof of Enterprise Florida notes.

Moreover, many of Florida’s companies and government agencies have taken proactive steps to safeguard their people, operations, and assets from severe weather, Vanderhoof says. Florida has miles of underground fiber, which helps to keep communication open. The state’s emergency

management experts are among the best in the country, he adds.

Landstar has a second service center in Rockford, Illinois. It’s fully staffed and can manage all calls and operations if the main office must close. “The company’s customers, agents, and owner-operators never miss a beat,” says Pat O’Malley, vice president, chief commercial and marketing officer.

Because the state is home to more than one dozen ports, it’s often possible to move a vessel or operation from one to another when a particular region is targeted. In addition, it’s rare that ports will close completely, Wheeler says. When they must, most work hard to quickly reopen—usually within hours; in rare circumstances, within a few days.