Vertical Focus: Consumer Packaged Goods

Green Things Come in Small Packages

The Sustainability Consortium, a global nonprofit focused on transforming the consumer goods industry, formed a new recycling coalition to address small-format packaging, which is commonly used in cosmetics and food supply chains.

Small-format packaging consists of items such as beverage bottle caps, lip balms, travel-size shampoo bottles, and other small packaging components that are unrecyclable in most curbside recycling programs due to the size of the screens used for sorting.

Consequently, most small-format items end up in landfills or become litter, rather than being repurposed in other products through a circular path.

The recycling coalition includes nonprofits, universities, and companies such as P&G, Burt’s Bees, and Colgate-Palmolive. Its aim is to improve circularity for small-format packaging of all material types through collective, sciencebased projects.

The coalition will perform a study involving a projection of the scale of collection to estimate economic value, and testing secondary sortation technologies. The findings will help create tools that can be used globally to create a more circular supply chain for small consumer products.

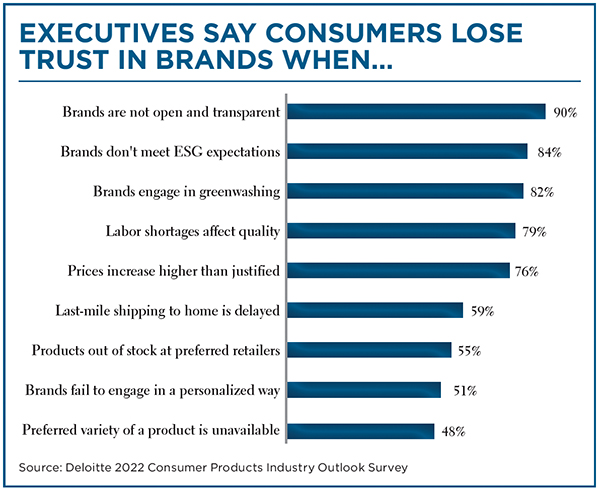

Consumer Loyalty is Built on Trust

Most executives say they’re investing significantly to prevent trust erosion on multiple fronts (see chart), a Deloitte report says, and it’s not hard to see why: 95% of consumer product companies that have high consumer trust are more resilient. Here are three things consumer product brands should keep in mind when it comes to maintaining trust, the report says:

1. Supply chain issues result in stockouts. Stockouts break the inherent promise of reliable availability and hurt perceptions of competence—not just of retailers but also of brands themselves.

2. Labor shortages reduce production and, in some cases, affect quality and service levels, further harming a brand’s perceived ability to deliver on its promises. Workers who don’t trust a company to create a sense of belonging are also unlikely to accept job offers or stay.

3. Rising prices that increase beyond what consumers view as justified break the promise of a fair deal. The intent and motive of the brand comes into question.

Penney for Your E-Commerce Strategy?

Like many department stores such as Neiman Marcus and Sears, J.C. Penney filed for bankruptcy during the pandemic. However, the decades-old American mall mainstay is getting more adaptable, says a Chain Store Age report. Some of its recent e-commerce upgrades include:

New fulfillment options: J.C. Penney expanded its curbside pickup and buy-online-pickup-in-store services by partnering with on-demand delivery platform DoorDash to offer same-day delivery from more than 600 stores. Shoppers can browse and order items such as makeup, skincare, fragrance, and haircare, as well as home goods, via the DoorDash mobile app or e-commerce site.

Smart predictive technology: To better understand how online shoppers make their purchase decisions, the retailer is using artificial intelligence technology from Metrical to streamline its digital customer experience. Since deploying the platform, J.C. Penney saw an 18% reduction in cart abandonment.

Tech-focused hires: Former Gap and Walmart executive Sharmeelee Bala joined the company as its chief information officer, responsible for the technology systems that support its stores and supply chain. Bala will help combine J.C. Penney’s physical assets with its digital footprint. Katie Mullen, previously with Neiman Marcus, was named chief digital and transformation officer and will lead the growth of its e-commerce business.

The appointments come shortly after Marc Rosen, who previously drove digital strategy at Levi Strauss and global e-commerce at Walmart, was named Penney’s chief executive officer in October 2021.

The Grocery Store of the Future

With the explosion of food delivery and contactless checkout, grocery stores offer a more seamless shopper experience across digital and physical interactions, with an emphasis on data collection and efficiency across the supply chain. Here’s what your trip to the grocery store will look like in two years, says a CB Insights report:

Text-based customer service. Phones and chat-based service options, such as Albertsons’ live chat for online grocery support and ShopRite’s registered dietitian chat, will be essential resources for grocery shopping.

Virtual and robotic kitchens. Virtual kitchens and robotic tools will gain traction. For example, Kroger partnered with delivery-only restaurant ClusterTruck to trial fresh meals for delivery, DoorDash acquired robotic salad maker Chowbotics, and grocery platform Ocado invested in made-to-order meals robot provider Karakuri.

Micro-fulfillment. As online grocery shopping grows, making fulfillment profitable is key. The micro-fulfillment market is projected to grow 10 times in the next four years, with Walmart already adding automated micro-fulfillment to several stores.

Sustainable packaging. Attention to reusable packaging reached an all-time high in 2020, aided by the EU’s ban on a variety of single-use plastics. Consumer product giants assert sustainable packaging commitments: P&G introduced refillable aluminum shampoo bottles, and Nestlé piloted in-store dispensers for pet food.

Cashierless self-checkout. Contactless payment will take over. Brands such as Dollar General already offer buy-online-pickup-in-store options. Just-walk-out technology has also spread among Kroger, 7-Eleven, Circle K, and Giant Eagle.

Cloudy with a Chance of Intelligent inventory

As consumer demand pushes retailers and consumer goods manufacturers to their limits, a new software-as-a-service solution can help them better anticipate demand surges.

SAS collaborated with Microsoft to create the SAS Cloud for Intelligent Planning. Available on Microsoft Azure, the solution predicts demand signals including when, where, and how sales will happen. With the benefits of the cloud, retailers can access timely data, increasing supply chain transparency and reducing the time it takes to complete a forecast.

The artificial intelligence creates self-tuning plans and makes sure the right products are in the right place at the right time, provides short-term demand sensing that turns consumer insight into action, and displays forecasts on any device.

By using comprehensive shopper data, the software recommends balanced, profitable commercial plans across a retailer’s channels and customers. Automated with machine learning, the cloud offering is always up to date. That means better on-shelf availability and a maximum return on investment for inventory dollars.