E-Commerce: The Complete Package

Smart and Sustainable is the only way to go.

Two and a half years after the pandemic caused e-commerce to accelerate, packaging and shipping methods continue to evolve. Consumers’ heightened awareness about sustainability and waste within the shipping industry, as well as economic pressures, lead the charge.

The writing was on the wall. Of the 82,220 tons of container and packaging materials generated in 2018, 30,470 million tons of it wound up in landfills, finds data collected by the U.S. Environmental Protection Agency (EPA). The figure amounted to 20.9% of the overall landfilling that occurred in 2018—and that was pre-pandemic.

It’s not uncommon for e-commerce packaging to be as much as 40% too large. As a result, more trucks, delivery vans, planes, and other transport modes are needed to move goods through the supply chain—a notable inefficiency further compounded by current driver shortages and high fuel costs.

“Once there was enough capacity in the market to be wasteful,” says Hanko Kiessner, founder and executive chairman of Packsize. “But the internet retail industry has reached a limit to its own scalability.”

TECH TO THE RESCUE

Theoretically, the human brain is perfectly capable of making packaging size decisions based on the outward appearances of products. In a pinch, however, and pressed for time, warehouse workers will pick the biggest box they know will fit without a doubt. Ultimately, they end up shipping a lot of dead space.

Load planning software takes the guesswork out of formulating packaging solutions. “Companies need to computerize and automate the whole load planning process because it’s not something they can solve with a spreadsheet, or a pen and paper, or by staring at a bunch of products and cartons to decide what will fit best where,” says Tim Smith, CEO at MagicLogic Optimization Inc.

The most comprehensive solutions meld both technology and sustainability. For example, DHL Supply Chain, the contract logistics specialist within Deutsche Post DHL Group, conceptualized its Opticarton packaging solution pre-pandemic.

“We wanted to make sure we were able to optimize our packaging in general but adopting and refining the solution became extremely relevant as e-commerce picked up,” explains Alicemarie Geoffrion, president of packaging operations.

The OptiCarton packaging solution is basically an algorithm that studies the actual contents of a package and, based on weights and dimensions, determines the optimum sized box and how to best place items inside it. It also provides packers with individual, visual instructions on how to ideally utilize the space inside the box so the right answer is more than just a hunch.

“Over time, with the rise of e-commerce, use of the algorithm increased,” adds Geoffrion. “And as it evolved, the next logical step was to combine it with some of our packaging-on-demand solutions.”

Thus, the AI solution OptiCarton was born, eliminating the need to have an inventory of different sized boxes on hand. “We’re able to leverage on-demand technology so that we can produce the right size box at the right time,” she says.

Customer research conducted by DHL Supply Chain reveals that 24% of e-commerce package volume is empty space. OptiCarton helps brands and retailers produce the right package at the right time for each shipment, which, in turn, drives down transportation costs and minimizes waste all while ensuring the product is protected.

FAIR GAME

At times, achieving smart and sustainable packaging solutions takes on the characteristics of certain games. In fact, Geoffrion likens the artificial intelligence used by OptiCarton to the video game Tetris, a classic puzzle game where players rotate and move falling geometric shapes to complete full rows without empty spaces.

“Our software effectively arranges the contents within a parcel to achieve cost and emissions savings,” she says.

One of the key logistics solutions offered by MagicLogic Optimization gets its name from another logical puzzle game, BlackBox, where the objective is to strategically acquire information to deduce the game board’s hidden solution. It’s not unlike collecting data to select the right box for orders in e-fulfillment, each and every time.

“A Black Box does something very clever, but in a mysterious way,” notes Smith. “All you have to look at is what goes in and what comes back out again.

MagicLogic’s BlackBox optimizer is an easy-to-integrate Windows service with an extensively researched and proprietary algorithm. Its main applications are:

Cartonization—the process of evaluating the size, shape, and weight of every item to be shipped to determine the optimal packaging option.

Mixed palletization—the process of placing goods together on top of a pallet to consolidate the load, using robotics. It utilizes true 3D placement of every item to deliver an optimal solution.

“A lot of warehouse management systems (WMS) say they provide cartonization load planning,” says Smith. “But what they really do is add up the volumes of all the boxes. If that volume is less than the volume of the shipping carton or container, they say it fits. That is a load of baloney.”

To prove his point, Smith describes a too long but very narrow product. “It’s still got a small volume but it won’t fit in the intended box, which is why you have to do true 3D placement,” he says. Being able to show potential customers an image also gives MagicLogic a chance to model some complex loading rules.

“We can illustrate why fragile Product A can’t be on the bottom or why Product B can’t be with Product C because they will explode if loaded together,” says Smith. “All this information comes into play at some point.”

When it all becomes more complicated than the average human brain typically wants to trouble itself with, having software that provides the right answer every time is both reassuring and cost-effective.

THE RIGHT STUFF

About 84% of consumers prefer their items be shipped via cardboard box versus plastic shipping envelopes and pouches, finds a March 2022 consumer study conducted by Packsize, an automated packaging solutions provider.

Furthermore, 87% of consumers who order online four or more times per week tend to patronize brands that demonstrate habits aimed at reducing their carbon footprint.

Sustainability is clearly top of mind for everyone. A box that is 40% too large needs 28% more paper than a rightsized box. Roughly 68.6% (per EPA data) of any plastic filling—styrofoam packing peanuts, air-filled pillows or others—included in that same oversized box ends up in landfills, where it sits for thousands of years to decompose.

Issues with sustainability and waste within the shipping industry are exactly why Hanko Kiessner founded Packsize, a company whose business model centers around rightsized packaging.

“I had the good fortune of being in my father’s business in the mid-1990s in Germany,” he says. “He pioneered the corrugated z-Fold material, which ultimately became the basis for all rightsized packaging on demand that exists in the world today.”

Adding up all of the paper necessary to make boxes that are 40% too large in the United States alone amounts to 5.8 million tons of extra paper—the equivalent of 98 million trees. If a box is 40% too large, 28% more corrugated is being used.

“It has to do with the geometry of how a box is folded and how two dimensions translate to three dimensions,” explains Kiessner.

A rightsized box not only reclaims the 28%, but filling material also shrinks by 90 to 100%, meaning none is usually necessary.

“The best level of protection is actually right-sizing the packaging and creating a perfect fit,” says Kiessner. “Shipping damages actually decrease when you switch to rightsized packaging on demand.”

Packsize eschews the use of plastic and participates in sustainability by using sustainable paper practices. Its proprietary z-Fold is made of 97% recyclable corrugated material that comes from trees planted for that specific purpose. When a tree is cut down to be turned into a box, a new tree is planted in its place.

A PLACE FOR PLASTIC

Amid all the conversation about sustainability, it might seem as if there’s no room at the table for plastic. However, insert the word reusable in front of it and suddenly plastic is seen in a different light.

During a time when companies are scrutinizing every point of their supply chain—including the packaging used to move their products—reusable plastic totes, pallets, and even dunnage and bulk systems gain street cred.

“Automation and plastic reusable packaging play nicely together,” says Andrea Nottestad, senior product manager at ORBIS Corporation. “Plastic offers the reliability needed as it relates to automation.” As a subsidiary of Menasha Corporation, the company’s focus has always centered on providing quality reusable packaging. In recent years, as e-commerce has evolved and accelerated, ORBIS has paid particular attention to the distribution environment.

So Long, Single Use

In today’s circular economy, limited or single-use packaging solutions such as fiber corrugated boxes and wood pallets are falling out of favor. Plastic on the other hand—especially varieties that, at the end of their lifecycle, can be recovered, recycled, and reprocessed into new packaging products—are getting the thumbs up and falling in line with customers’ expectations regarding sustainability. As studies note, consumers have a more positive image of and are more loyal to a company that supports social and/or environmental issues.

“It’s such a good environment right now for returnable packaging,” notes Nottestad. “Areas of the supply chain are evaluating it more seriously than they have in the past. They’re coming back and looking at it again.”

Some of the drivers prompting that second look include seeking to improve labor inefficiencies, reduce costs, and achieve throughput objectives and sustainability goals.

Right-sizing factors into this domain as well. “You don’t want to ship a lot of air on a truck,” says Nottestad. “With reusable packaging you start to home in on some standards that fit the efficiencies for the majority of your product. Those standards then become the basis to build off and around other parts of your process to achieve added efficiencies.”

Using dividers or subdividing containers is common; it ensures that a plastic tote, for example, is densely packed rather than sitting half full.

“Trying to drive as much cube as possible into containers has long been a focus for ORBIS, but we look at it across the entire supply chain,” says Nottestad. Concern extends beyond a single point of use.

In other words, ORBIS wants to know where that tote is going next. Will it be palletized? Will that pallet then end up on a truck? Will ORBIS cube out the truck and take all these factors into consideration? Inefficiencies in a transport vehicle can quickly offset savings achieved elsewhere. “We keep all that in mind,” says Nottestad.

CHOOSING REUSING

Smart and sustainable packaging solutions are just one piece of the puzzle. Shipping pallets—those ubiquitous workhorses that basically serve as the underpinnings of the entire supply chain—deserve consideration too.

Companies are beginning to discover the value of recycled plastic pallets, once exclusively made of wood, such as the variety supplied by iGPS Logistics.

Plastic pallets were shown to have a longer lifespan than similar wood block pallets, according to a 2020 study conducted by Environmental Resource Management, a global consultancy. The study concluded that iGPS’s virgin and recycled plastic pallets have significantly less environmental impact than pooled multi-use wood pallets.

In fact, iGPS recycled more than 32 million pounds of post-consumer and post-industrial plastic into pallets in 2021 alone. That figure represents just part of the more than 208 million pounds the company has recycled over the past seven years.

The company estimates that by shipping lighter plastic pallets, their customers kept more than 28 million pounds of greenhouse emissions out of the atmosphere in 2021.

Out of the Pool

iGPS was founded as a plastic pallet pooling company. “We identified an opportunity early on that plastic would perform more efficiently and effectively in the supply chain,” says Harrison Dean, executive vice president. “Being lighter weight, plastic pallets allow you to cube a truck out versus weight it out. Their streamlined design means they perform more efficiently in automated circumstances.”

Plastic pallets keep their structural integrity, unlike wooden pallets that are prone to splintering. Moisture might cause a wooden pallet to expand whereas a plastic pallet maintains its dimensions throughout the entire supply chain.

iGPS’s plastic pallets are outfitted with RFID chips to keep track of them throughout their lifecycle—which averages 7 to 10 years depending on the product. After that they will, without a doubt, be recycled into a new generation.

Ultimately, new generations of packaging and support systems are how e-commerce will continue to scale its inefficiencies and become more sustainable.

Packing it in

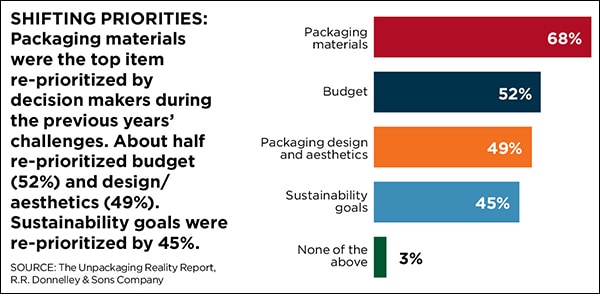

Today’s most pressing challenges forced packaging decision makers to shift priorities and rethink operations, with 90% changing how their packaging is sourced, finds a new study released by R.R. Donnelley & Sons Company. The Unpackaging Reality Report’s key findings underscore the packaging industry’s willingness to evolve operations in the face of challenges without losing sight of sustainability goals:

1. Supply chain challenges lead to innovation. To navigate market challenges, 62% of respondents diversified suppliers, 42% outsourced manufacturing and fulfillment, 39% consolidated suppliers, 30% substituted specs, and 26% reshored manufacturing to the United States. There is broad willingness to pivot to different packaging materials in light of supply chain sourcing challenges: 36% say they are extremely willing to use alternative materials. As for guidance and information, 78% of respondents look to suppliers, vendors or direct manufacturers.

2. E-commerce ignites packaging demand. The majority of respondents (57%) experienced an increase in e-commerce orders in the past 1-2 years and, for nearly all of them (92%), this resulted in an increase in packaging needs.

Packaging professionals responded to growing e-commerce orders by increasing inventory (55%), expanding warehousing (53%), changing materials (52%), and increasing staff (51%).

3. Surprising strides in sustainability despite cost pressures. Almost all respondents (94%) agree that sustainability is a key consideration in packaging and label decisions. Further, two-thirds of packaging professionals shifted to more sustainable packaging than what they used previously. When considering sustainability, budget is the top influencing factor—more so than external regulations or consumer preferences—suggesting that cost-effective eco-friendly materials are in high demand.

Of note, the majority of packaging decision makers (55%) say recent supply chain disruptions moved their companies closer to their carbon emissions goals, suggesting sustainability initiatives may prove versatile and resilient.