Global Logistics—July 2013

Brazilian Shippers Safer by Sea

Poor road infrastructure and rampant larceny are forcing some Brazilian shippers to consider unconventional transport options. Case in point: Paranapanema, the country’s largest refined copper producer, has shifted domestic shipments from trucks to slow-moving ocean freighters, according to Bloomberg Businessweek. Although the mode shift nearly triples transport times, it cuts costs 21 percent by eliminating the potential for piracy.

The 1,000-mile, eight-day trip from Paranapanema’s plant in Bahia to a DC in Rio de Janeiro via water is preferable to three days by truck because it’s ultimately less expensive and safer. The company transported 65 percent of its domestic deliveries by ship in 2013, and plans to ramp up to 80 percent by year’s end. In 2012, it didn’t ship anything by water—but it was also the victim of 15 hijacked truckloads.

That shippers are willing to negotiate port bottlenecks and longer shipping times speaks to the gravity of Brazil’s crime problem. Approximately $468 million worth of cargo was stolen last year on the country’s roads, 37 percent more than in 2006, according to Setcesp, São Paulo’s cargo transport industry association.

Using sea transport delivers two additional outcomes: Paranapanema has reduced carbon emissions by as much as 65 percent; and the company is considering relocating its Rio DC closer to the port to gain additional efficiencies and economies.

Global Trade Key to SMB Success

International trade and cooperation is a key driver for small business success, according to a study by market intelligence company IHS Global Insight and German expediter DHL Express.

Small and medium-sized businesses (SMBs) engaged in international markets are twice as likely to be successful than those that operate only domestically, reveals the report, which surveyed 410 SMBs in G7 and BRICM (Brazil, Russia, India, China, and Mexico) economies.

Of the companies polled, 26 percent that trade internationally also significantly outperform the market, while just 13 percent of domestic-only SMBs also outperformed the market. Smaller shippers cite several key benefits of an international approach, including access to new markets and technology, as well as stronger product and service diversification.

Inadequate business infrastructure can constrain a company’s competitiveness due to the reduction of business efficiency, the study documents. For example, SMBs have to work harder to overcome inefficiencies compared to larger companies with greater resources. The lack of available information on foreign markets, high customs duties, difficulty in establishing contacts with foreign partners, and ability to successfully generate an overseas customer base are the most significant concerns for companies that trade internationally.

Among other findings:

- SMBs that were established in the past five years are more likely to have international business operations than older SMBs, despite having had less time to grow their businesses.

- The majority of SMBs that have outperformed their markets during the past three years indicate they also plan to increase the percentage of exports in their turnover over the next three years, despite the uncertain economic environment.

- BRICM SMBs place more emphasis on logistics as a positive influence on their international operations than their G7 counterparts, suggesting that they rely more on efficient transportation and customs processes to overcome infrastructure obstacles.

Amazon’s Wage War, Euro Trippin’

Amazon workers in the town of Bad Hersfeld and city of Leipzig, Germany, are on strike, arguing their wages should be in line with what’s paid in the country’s retail sector rather than the lower pay scale common in the logistics sector. When polled early in 2013, 97 percent of the e-tailer’s 9,000 German workers voted for industrial action.

Amazon contends workers are primarily doing a logistics job by packing and mailing, and says it pays on the upper end of that scale. Thus far, the intermittent walkouts have yielded little reaction from the online retailer. If Amazon’s defiance over paying online sales tax in the United States is any indication, this stalemate could last a while.

Germany is Amazon’s second-largest market behind the United States, and just ahead of the United Kingdom and Japan. The company operates eight sites across the country, including the two logistics centers in Bad Hersfeld and Leipzig.

A labor strike in Germany isn’t Amazon’s only challenge. Amid Europe’s lingering economic plague, the company has encountered fast-spreading civic unrest of its own.

In France, all things being equal, there is no such thing as free shipping. The government recently announced plans to introduce a law that would prevent Amazon from offering discounts, arguing such incentives are tantamount to unfair competition. Traditional booksellers support the measure, believing that the online retailer threatens their business model by undercutting prices.

“I’m in favor of ending the possibility of offering both free delivery and a five-percent discount,” said Aurelie Filippetti, minister of culture and novelist, in a recent interview with French media. “We need a law, so we’re going to find a legislative window to introduce one.”

France, like other European countries, bans retailers from discounting books more than five percent from the publisher’s sale price to protect smaller booksellers. This latest dust-up with Amazon underscores recurring problems between the French government and U.S. e-tailers looking to penetrate the market. France settled a dispute with Google in February 2013 over whether it should pay content providers for linking to news articles.

This legal action also demonstrates why the country has become anathema to U.S. foreign direct investment, trailing the Netherlands, United Kingdom, Luxembourg, Ireland, Switzerland, and Germany as favored targets in Europe.

FedEx Targets Africa

As yet another indication of Africa’s rising star and growing global connectivity, FedEx has completed the first stage of a strategic acquisition by signing agreements to acquire the businesses operated by Supaswift, its current licensed service provider in South Africa, Malawi, Mozambique, Swaziland, and Zambia. The expediter is also in discussions to take over the company’s businesses in Botswana and Namibia.

The acquisition augments FedEx Express’s presence in Africa with 39 facilities across seven markets, and will offer a complete suite of FedEx-branded export, import, and domestic solutions, connecting southern Africa to more than 220 countries and territories worldwide, and enhancing customers’ business flexibility and speed to market.

FedEx Express has been active in Africa since the early 1990s through a well-established network of local service providers. The consolidation of Supaswift’s assets under the company brand is expected to raise the level of service capabilities and expectations in one of the world’s fastest-growing regions.

FedEx on the Move

Since 2011, FedEx has been aggressively acquiring companies in emerging markets.

2011—AFL/Unifreight (India)

Acquisition boosts domestic transportation and value-added capabilities.

2011—MultiPack (Mexico)

MultiPack’s existing operations include a pick-up and delivery network, warehousing and logistics services, DCs and warehouses, and 500+ retail outlets.

2012—Opek (Poland)

Acquisition provides access to a nationwide domestic ground network with $70 million in annual revenue and 12.5 million shipments annually.

2012—TATEX (France)

FedEx gains a nationwide domestic ground network that carries 19 million shipments and produces $200 million in revenue annually.

2012—Rapidão Cometa (Brazil)

The latest step in the company’s strategy for profitable growth in FedEx Express’s Latin American and Caribbean region.

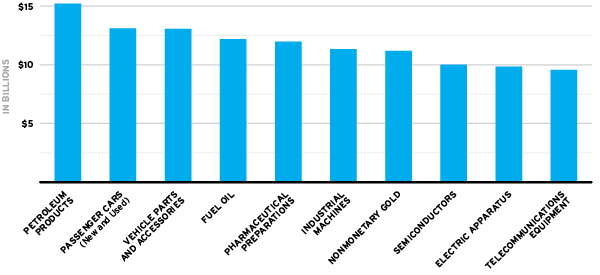

Top 10 U.S. Exports, Q1 2013

Exports of petroleum products increased 36 percent in the first quarter of 2013, and expectations continue to grow for coming quarters. High-value, high-tech products such as semiconductors and electric apparatus also placed among Q1’s top 10 exports.

Source: Zepol Corporation

China Considers Nicaraguan Canal

The Chinese government stirred speculation in 2011 when it announced plans to build a dry canal through Colombia that would rival next-door neighbor Panama.

While those rumors have subsided, recent news that Nicaragua’s government has commissioned Hong Kong-based HKND Group to study the feasibility of building a new shipping channel between the Pacific and Atlantic oceans is again raising interest—whether or not it comes to fruition.

The $40-billion shipping route—which would be directed through the waters of Lake Nicaragua—will be deeper, wider, and longer than the Panama and Suez canals, reports UK newspaper The Guardian. It will also be able to accommodate ships weighing 275,000 tons, double the size of the vessels that pass through Panama.

The canal’s construction—expected to take one decade to complete—would likely have widespread geopolitical consequences, weakening U.S. control of trade through the region, and reaffirming China’s position as a global superpower, says The Guardian.

China’s reputation for financing and fast-tracking major domestic infrastructure projects is quickly gaining traction elsewhere around the world. The country has initiated plans to help build a $10-billion, 20-million-TEU port at Bagamoyo in Tanzania, scheduled for completion by 2017. China’s investment is motivated by the region’s abundant mineral resources, including iron ore, gas, oil, and coal.

CN Chafes at “Fair” Rail Regulation

Canadian officials believe the passage of Canada’s Fair Rail Freight Service Act will improve relations between shippers and carriers. Canadian National (CN) begs to differ.

A 2011 Rail Freight Service Review Panel recommended the use of bilateral service agreements between shippers and railways as an effective way to bring more clarity, predictability, and reliability to rail service. This new legislation builds on that by encouraging shippers and railroads to negotiate service agreements, and providing incentives for faster arbitration.

Canadian rail shippers have widely lauded the new regulation for providing a better framework that supports healthy and fair competition. Railroads, however, see encroaching regulation as a negative influence.

The government’s review, initiated in 2008, was a catalyst for CN to launch collaborative agreements with customers and partners in all business sectors, including a scheduled grain service in western Canada, supply chain collaboration agreements with Canada’s major ports and intermodal terminal operators, and commodity-specific improvements.

“The government should have recognized these successes and resolved to promote further progress within a commercial framework,” says Claude Mongeau, CEO of CN. “Instead, it adopted new regulation that could chill supply chain innovation that benefits both the rail industry and its customers.”