White Glove Delivery Strategies and Techniques

When consumers were sent home to work, big and bulky e-commerce orders took off, along with white glove delivery expectations. The right combination of technology and strategy can help retailers meet them.

Saying that e-commerce shipping has had an eventful two years would be an understatement.

The pandemic accelerated the shift toward online retail by five years, reports the 2020 IBM U.S. Retail Index. E-sales hit $211.5 billion in the second quarter of 2020 alone, a 44.5% increase from the year prior, according to the U.S. Census Bureau.

There were notable fluctuations within that trend as well. Prior to 2020, e-commerce had mostly been the purview of small items, such as books or apparel. Once consumers started working from home, however, sales in those verticals gave way to larger, more complex purchases—furniture, home offices, exercise equipment, and appliances.

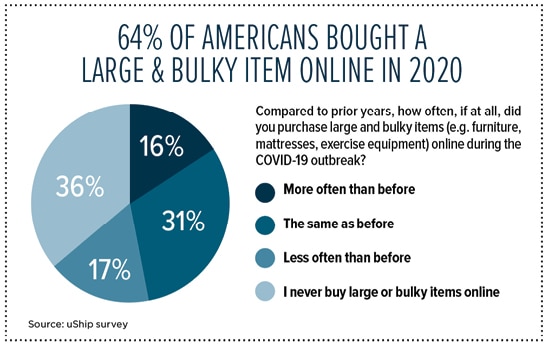

A 2021 uShip survey found that 64% of Americans purchased a “big and bulky” item online in 2020 (see chart); 73% of respondents bought these products at a higher frequency than they had before COVID, and 45% said they would continue to shop for large products online after the pandemic ended.

As online sales of large or expensive items grew, so did the challenges of steering these products through the final mile. Unlike smaller items, the “big and bulky” delivery experience played a key role in a consumer’s decision to continue to shop with a merchant, according to uShip. More than 50% of respondents placed a premium on visibility, communication, and carrier professionalism in their decision to shop with a particular merchant.

The stakes are high for large and bulky deliveries so they need to be handled with white gloves.

Special Delivery

One hallmark of the pandemic was reduced foot traffic to brick-and-mortar outlets. E-commerce filled the sales vacuum, but it came at the price of brand anonymity. Delivery upgrades can keep consumers in touch with a brand, even when they are wary of setting foot in a physical store.

“White glove is an opportunity to offer amazing service beyond the warehouse,” says Brian Bourke, chief growth officer at Chicago-based third-party logistics provider SEKO Logistics. “It’s an extension of the in-store experience, something that consumers don’t always get with e-commerce.”

There’s a lot riding on that encounter. In its Last Mile Mandate Consumer Survey, delivery management platform FarEye found that 85% of consumers won’t patronize a retailer again after a bad delivery experience.

There are a few ways to manage brand representation: proactively communicate arrival times, maintain a pleasant demeanor, and answer all of a consumer’s questions. These approaches contribute to a positive delivery experience. And if a product arrives damaged, the carrier could offer a repair and maintenance service.

“Fixing a scratch or a dent can go a long way toward making the customer happy and preventing the loss of a sale,” Bourke says.

How’d We Do?

On a macro level, companies can measure delivery performance over time and find out where improvements need to be made. For example, GoShare, a last-mile platform that connects drivers with loads, lets consumers rate their experience on a 1-5 scale and provide written feedback.

“Our drivers consistently average scores around 4.9 out of 5,” says Shaun Savage, GoShare CEO and co-founder. “Retailers appreciate access to this data because it ultimately helps them improve their efficiency over time.”

Depending on the item being delivered, different levels of service might be required once a shipment reaches the front door. Baseline white-glove assistance typically involves entering the consumer’s home, placing items in the room of choice, unpacking, and hauling away debris.

More recently, white glove has expanded to include product assembly, installation, or even providing a brief tutorial that explains how to use a new purchase—known as the “final inch” of delivery. This could involve, for example, wall-mounting a TV or installing home exercise equipment.

For certain retailers, these offerings are baked into the delivery process. But white-glove service can also be an upsell opportunity.

“It’s easy to think that you won’t need white-glove service if you order a bed online,” says Shailu Satish, co-founder and chief operating officer of DispatchTrack, a last-mile optimization platform based in San Jose, California. “That is, until the bed arrives in one box outside your house, it’s too heavy to move inside, and your bedroom is on the second floor.”

White Glove on the Spot

In situations like those, it behooves companies to have an option to add white-glove service on the spot, Satish explains. DispatchTrack’s customer communication software includes a field that lets drivers upgrade a delivery on-site. From there, DispatchTrack automatically updates the provider’s ETA and charges the customer.

“This is a win for everybody,” says Satish. “Customers receive the service they need, and it’s additional revenue for the retailer and pay for the driver.”

The trick is to offer optionality at different stages of a sale. For example, a high-end furniture manufacturer selling a $15,000 dining room set might automatically include a delivery upgrade, which would be in line with the consumer’s expectations.

On the other hand, a home improvement retailer who offers products at a wide range of prices could offer a white-glove delivery option alongside free delivery at checkout, and let the consumer decide which one they want.

Just five years ago, communication in the last mile would typically have involved a phone call between the consumer and the delivery driver. Today, shoppers expect automated updates, push notifications, and text messages.

“The best way to communicate with a consumer used to involve picking up the phone,” says Lance Dearborn, vice president of white-glove courier Need It Now Delivers, in Flushing, New York. “Now, if they get a call from a phone number they don’t recognize, they’re more likely to ignore it. Consumers don’t want to talk to us.”

Instead, Dearborn explains, shoppers have grown accustomed to the “Amazon mold”, where they receive auto-generated updates that offer visibility into every shipping milestone. It’s something that consumers at all levels are coming to expect, but especially if they’ve ordered a complex or expensive item.

Take shipment scheduling. White-glove service used to mean that carriers would contact the consumer one or two days ahead of delivery, and plan to arrive any time between 8 a.m. and 5 p.m.

“The customer had to take a full day off from work to wait for a delivery, and sometimes the driver wouldn’t show up,” notes Carson Krieg, head of last mile industry solutions and strategy at project44, a visibility platform headquartered in Chicago.

Now, consumers who purchase white-glove service gravitate toward self-service appointment scheduling with a narrow—think: two hour—delivery window.

By keeping consumers up to date on shipment status, tracking technology reduces confusion and speeds delivery time. “The technology eliminates the need for the buyer to answer a call from a carrier they aren’t familiar with,” says Krieg.

There is one exception to the no-talking rule. In some circumstances, consumers need to provide specific instructions to the delivery driver, so they expect a mechanism to facilitate easy communication.

“The consumer may need to tell the driver about a last-minute change, or ask them to pull around to the back of a house,” says Bourke. “Being able to call from a masked number, similar to a ride-share app, has become table stakes.”

“Extremely Complex”

Tight delivery windows are well received by consumers, but a web of challenges are involved in trying to meet them, says Daniel Vanden Brink, global vice president of customer success at Locus, a last-mile logistics platform in Wilmington, Delaware.

Accommodating the estimated time of arrival means coordinating driver schedules with the consumer’s selected delivery window, accounting for needed services, integrating with the order management system to ensure available logistics capacity, and providing visibility and a means to communicate with drivers. It also means scaling up to meet consumer demand.

“All of those things are extremely complex,” notes Vanden Brink.

Having the right set of tools can help smooth out the complexities of white-glove delivery. For example, FarEye’s platform matches workers with the needed skill set to a particular job. “A different set of personnel will deliver a dishwasher versus assembling a TV stand,” says Jorge Lopera, vice president of global strategy at FarEye. “Without the right technology, you have to find workers who know how to do everything.”

Companies can also use artificial intelligence-backed, cloud-based technology to optimize schedules. For instance, the Locus platform calculates maximally efficient routes, in part by predicting how long it will take to assemble or install the items being delivered.

The tailored consumer experience is more than a passing fad, asserts McKinsey & Co in its report, The Future of Customer Experience: Personalized, White Glove Service For All. If anything confirms that, it’s Amazon’s 2021 roll-out of a white-glove test service for furniture deliveries.

The good news, according to McKinsey, is that needs-based service offerings can deepen consumer trust and loyalty and support retention, even to the point of increasing revenue.

To realize these gains, companies must anticipate and respond to consumers’ needs. That will require them to foster true commitment to the customer experience, both in back-end and customer-facing roles.

Get it right, and your organization moves to the front of the pack.

Meeting in the Middle

The final mile may be the most visible part of white-glove delivery, but retailers and manufacturers can take steps prior to it to ensure a successful end result. A primary consideration: avoiding damage in the middle mile.

One way to cut down on accidents is to minimize how often shipments are handled. For that reason, avoid sending palletized freight through a hub-and-spoke network or using an LTL carrier, recommends Carson Krieg, head of last-mile industry solutions and strategy at project44. There’s too much propensity for damage when items have to be moved or reorganized.

“Forklifts could drive through the side of a couch,” he says. “Situations like that create a lot of damage in a hand off from carrier A to carrier B.”

Instead, shippers with enough density may benefit from booking dedicated truckload capacity and floor loading their freight. Once products arrive at the destination market, retailers could hand them off to a final-mile-only provider, or even choose to handle the last mile in-house. “It’s an opportunity to resolve issues in the last mile,” Krieg says. “Retailers are going upstream, and controlling their own destiny there.”

White Glove in Reverse

Most consumers are accustomed to returning small or low-value items that they bought online. When they need to return a large and bulky item, however, it’s a different story.

“You can’t just put a label on a lawn tractor and take it to UPS or FedEx,” says Greg Boring, vice president of integrated sales at Kenco. “There are no built-out reverse logistics networks for those returns.”

It’s tricky, he explains, but shippers can enable a white-glove return process in a few ways.

To ensure a smooth returns process, retailers should first assess the value of the item in question, and decide what acceptable terms and conditions would look like. A consumer might be responsible for returning a $500 grill, for example, while a delivery company might haul away a $15,000 couch for free.