Global Logistics—June 2014

Light at the End Of the Chunnel

UK and continental shippers can expect a price reprieve after Eurotunnel announced plans to reduce freight rates through the Channel tunnel. The move comes after the European Commission began legal action to reduce charges and increase traffic.

Paris-based Eurotunnel, which operates trains through the tunnel, will cut tariffs for off-peak services at night during the week, and reduce prices by one-third during tunnel maintenance.

The European Commission welcomed the decision to reduce track access charges by up to 50 percent, expecting it to double rail freight volume through the tunnel in the next five years.

"Because rail freight traffic through the Channel Tunnel has increased 10 percent in 2013, and 13 percent in the first quarter of 2014, we decided to reinforce our efforts to support the development of this traffic," says a statement from Eurotunnel.

In response, European Commission Vice President Siim Kallas says the decision "stands to unblock a major bottleneck in Europe’s transport network," and is good news for business, consumers, and the environment.

When Continents Collide

If Turkey and China have their say, the world as we know it might be a train ticket away.

Turkey is doubling down on efforts to improve traffic flow between the European and Asian sides of Istanbul across the Bosphorus Strait, which separates the two continents. In October 2013, the government opened the long-awaited 8.5-mile Marmaray railway tunnel project, the first physical rail link between Asia and Europe. Now, excavation work for a $1.2-billion, 3.4-mile double-deck road tunnel is underway, following a similar course. When it opens in 2017, the new tunnel is expected to reduce current over-the-road travel time from 100 minutes to 15 minutes, while handling 120,000 vehicles per day and improving traffic flow.

Turkey’s aspirations are becoming reality. China’s recently announced plans, meanwhile, are a figment of fancy. The government is no stranger to big ideas—the country has proposed a $10-billion port in Tanzania, a $3.8-billion rail line between Mombassa and Nairobi, Kenya (see sidebar, below), a dry canal in Colombia, and a wet one through Nicaragua.

But now China is upping the ante with the idea of building an 8,000-mile-long rail line that would link China, Russia, and Canada through Alaska.

Chinese officials are considering a route that would start in the country’s northeast, thread through eastern Siberia, then shoot the Bering Strait via a 125-mile-long underwater tunnel into Alaska—more than four times the length of the Channel Tunnel connecting England to France, a Beijing Times report suggests. Similar rumors of a tunnel eventually connecting China to Taiwan are also circulating.

Alaska is familiar with over-hyped infrastructure projects that inevitably lead to nowhere. China’s bluster may be just that. But the country also has a track record of thinking and executing without reproach. Only time will tell.

Green Down Under

Trucks traversing Australia’s red rock desert might soon find a green oasis. Germany-based PTV Group, a traffic consulting and software company, signed an agreement with Emisia S.A., a spin-off company of the Laboratory of Applied Thermodynamics at Aristotle University of Thessaloniki in Greece, to provide the first standardized emissions calculation methodology for vehicle routing and optimization solutions in Australia.

The two companies have developed COPERT Australia, a database specific to Australia’s route network, which enables detailed calculation of CO2 emissions for heavy-duty vehicles.

COPERT calculates greenhouse gas and air pollutant emissions from road transport, covering all important vehicle classes and driving conditions. It includes algorithms developed from data collected in Australian test programs designed to reflect the Australian fleet and activity data.

US Questions Russia’s Trade Designation

Machinations in Washington could withdraw Russia’s designation as a beneficiary developing country under the Generalized System of Preferences (GSP), suggests a recent report by international trade services provider Sandler, Travis & Rosenberg. The GSP program promotes economic growth in the developing world by providing preferential, duty-free entry for up to 5,000 products when imported from one of 123 designated beneficiary countries and territories.

Influenced by current events in Ukraine, and the threat of economic sanctions, the Obama administration says Russia has developed its economy, and improved trade competitiveness to the point where it no longer warrants special consideration. Both the European Union and Canada have made similar motions, according to the report.

The primary criterion for such changes is typically a country’s designation as "high-income" by the World Bank, which put Russia in that category in its 2014 World Development Indicators report.

While the administration mulls its options, revoking Russia’s GSP benefits will have no immediate effect. The program remains suspended after Congress failed to reauthorize it in 2013, so goods from Russia, as well as all other beneficiaries, are already subject to normal tariffs when imported into the United States. If the GSP is reinstated as expected in 2014, however, Russian goods would then be at a disadvantage in the U.S. market.

The Sandler, Travis & Rosenberg trade report posits another consideration that may force Washington’s hand. The U.S. business community is pressuring the Obama administration to reinstate GSP, claiming domestic manufacturers have lost sales and laid off workers because they have been paying an extra $2 million daily in tariffs on imports that cannot be sourced domestically.

Lawmakers cite the fact that Russia is currently a GSP beneficiary as one factor standing in the way of a reauthorization. Once that is no longer the case, members of Congress could find it politically easier to renew the program.

Port Metro Vancouver on Right Track

The nearly two-month labor standoff at Port Metro Vancouver that ended in late March 2014 might have a silver lining for all players involved. One complaint raised by striking truckers was the lengthy, non-productive waiting times they had to deal with on terminal.

To alleviate that problem, the port recently announced it would spend $1.7 million to expedite and expand its truck GPS program in 2014. In 2012 and 2013, GPS units had already been installed in half the container trucks operating under the port’s truck licensing system.

By having a better grasp on the location of its container trucks, the port hopes to reduce congestion and driver wait times.

Wealthy Economies to Enrich Global Trade in 2014

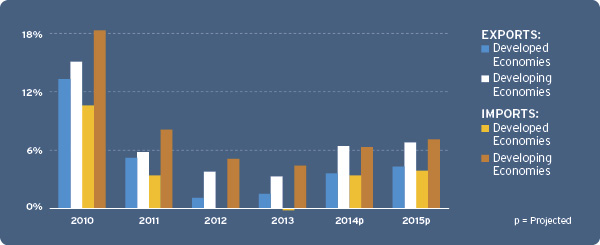

The World Trade Organization (WTO) recently adjusted its outlook for global trade, predicting that commerce will grow by 4.7 percent in 2014, adjusted up from its previous 4.5-percent forecast. Recovery in developed economies is expected to offset sluggish emerging nations. The WTO’s newest assessment indicates worldwide trade will more than double 2013’s 2.1-percent growth.

Asia will continue to drive growth rates even as China’s expansion slows. The WTO expects Europe and North America’s recoveries to drive both imports and exports.

If GDP forecasts hold true, the WTO projects a broad-based, but modest, upturn in 2014, and further consolidation of this growth in 2015.

World Merchandise Trade and GDP, 2010-2015 (Annual % Change)

World merchandise trade is expected to post a 4.7-percent increase in 2014, with developed economies growing 3.6 percent, and developing economies and the Commonwealth of Independent States advancing 6.4 percent.

Source: WTO Secretariat for Trade, GDP concensus estimates

French Fry M&A Activity

French protectionism is alive and well. The government has issued a decree allowing it to block any foreign takeovers of French companies in strategic industries, according to a Reuters report. The gambit puts a hold on General Electric’s expected $16.9-billion bid for high-speed train builder Alstom’s energy assets.

The new order gives the state even more power to block foreign takeovers in the energy, water, transport, telecom, and health sectors. Acquisitions will now require approval from the Economy Minister.

Many would prefer that French-owned Alstom seek an alliance with another European engineering company—notably Siemens. But the effort is likely to give foreign investors further pause as they look to make inroads in certain markets.

Supporters suggest the decree merely enables the government to ensure certain industries are protected, and that it’s no different than powers afforded other European countries and the United States.