TAKEAWAYS: Shaping the Future of the Global Supply Chain

Logistics and supply chain news and highlights shaping the future of global logistics.

Highs & Lows of SC Decarbonization

The past few years have been a mixed bag for supply chain decarbonization efforts in sectors such as pharmaceutical, automotive, consumer goods, and retail, finds new data from supply chain intelligence network, Secaro (formerly Manufacture 2030).

“The climate and sustainability market has been characterized by change and uncertainty in 2025. There has been big politically motivated change, last-minute delays to regulation, and increasing complexity,” says Toby Newman, CEO, Secaro. “Hundreds and thousands of companies around the world have been left unsure how to respond, plan, and forecast. So, it’s not surprising that businesses have exercised some caution around supply chain decarbonization—prioritizing optimization and efficiency over actions with higher CAPEX costs.”

But despite the challenging market conditions, businesses are still committing to, and pursuing, decarbonization targets, Newman adds.

Secaro’s data comes from 43,652 actions taken by 2,552 businesses within the pharmaceutical, automotive, consumer goods, and retail sectors—including M&S, Ocado Retail, AstraZeneca, and Honda—and across 89 countries and 4,086 facilities. The companies shared primary data covering commitments and targets, energy, emissions, reduction plans, water, waste, high-impact materials and commodities, and risks and dependencies, providing in-depth insight into the state of play in global supply chains.

Here are some key data points supporting both sides of the decarbonization picture:

- 90% of supply chain emissions-reduction actions recorded by businesses between 2020 and 2025 focused on optimization and improving energy efficiency. Data shows a surge of decarbonization actions completed between 2022 and 2023, with over half (56%) of actions completed during this two-year period.

- 73% of renewable energy actions were also completed in this two-year period, with a strong focus on photovoltaics (solar).

- 70% of respondents have emissions-reduction targets.

Additionally, data shared in 2025 shows a slowdown in supply chain decarbonization actions, with overall completed actions down 53% compared to data shared in 2024. This brings activity back down nearly to 2021 levels as businesses faced inflationary pressures and increased costs.

Mexico’s Tariff Moves

At the tail end of 2025, Mexico announced its decision to implement new tariffs of up to 50% on more than 1,400 industrial products. This marks a significant inflection point for North American trade—and a potential preview of what’s ahead in 2026, according to a recent analysis by Drew DeLong, head of corporate statecraft at Kearney Foresight, a division of global strategy and management consultancy Kearney.

The tariffs target imports from countries without free trade agreements with Mexico, affecting a broad swath of industrial categories including chemicals, plastics, base metals, machinery, parts, and electronics. While the EU and members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) are largely spared, major exporters such as China, India, and South Korea are not.

“The non-FTA designation of the impacted products means that China, India, and South Korea will not be spared from Mexican tariffs,” explains DeLong. “The list of 1,463 industrial products Mexico plans to hit with tariffs up to 50% is broad and strategically significant.”

For supply chain leaders, the implications extend beyond cost:

- Mexico’s move—combined with recent Canadian trade restrictions—may signal the early stages of a more protectionist regional model. “With Canada also imposing trade restrictions, a new ‘fortress North America’ trade model could be emerging,” DeLong notes, pointing to Canada’s recent reduction in steel quotas from non-FTA countries and new tariffs on derivative products.

- Geopolitical fallout may follow quickly. China has already denounced Mexico’s tariff law, and DeLong expects retaliation to be likely. “I would not be at all surprised to see direct retaliation by China,” he says, warning that escalation could draw the United States into renewed trade tensions if it aligns with Mexico.

- The policy shift may also intersect with other negotiations. DeLong suggests that U.S. fentanyl tariff discussions with Mexico and Canada could merge with USMCA talks into a broader effort to advance a North American-centric trade framework.

6 Key Risks for Auto Suppliers

Automotive supply chains in North America today face a complex landscape due to economic volatility, electrification initiatives, and regulatory pressures. As a result, risk is a constant challenge—and mitigating that risk is always top of mind.

A new report from Moody’s, Navigating Disruption in Automotive Supply Chains, breaks down these six key risks that automotive suppliers must battle in 2026:

1. Financial vulnerability and demand fluctuations

Suppliers are highly exposed to sudden production shifts, raw material price swings, tariffs, and rising interest rates, putting smaller firms at greater risk of insolvency. Early warning signs often include quality lapses, delivery delays, and unexpected freight cost increases.

2. Electrification challenges for EV part suppliers

EV suppliers face heightened risk due to dependence on critical minerals, battery capacity, and specialized semiconductors—much of it still sourced from Asia. With fewer but more complex components, any disruption can have outsized effects across the EV supply chain.

3. Aftermarket reliance and service part risks

With the average vehicle age reaching 12.8 years, aftermarket parts now drive most service demand. Disruptions among lower-tier suppliers threaten vehicle uptime and increase inventory complexity and capital tied up in parts networks.

4. Safety, regulatory, and recall risks

Safety recalls remain costly and prolonged, as seen in past crises that took years to resolve. When financially distressed suppliers are involved, OEMs often shoulder liability, regulatory scrutiny, and reputational damage.

5. Operational challenges: combustion vs. EV supply chains

While EVs have far fewer mechanical parts than internal combustion engine vehicles, they rely heavily on electronics, software, and specialized materials. This shifts risk toward battery diagnostics, high-voltage safety, and software support, increasing training and aftermarket demands.

6. Cyber risk

Highly interconnected automotive supply chains present expanding entry points for cyberattacks, with most industry leaders viewing supplier networks as vulnerable. As digital and AI-driven systems multiply threat vectors, stronger supplier vetting, cybersecurity standards, and workforce training are increasingly critical.

Low Demand, Leaner Teams

As the freight industry moved into the final months of 2025, logistics operators began to recognize a shift in seasonal dynamics. Demand that has traditionally surged late in the year proved more muted and uneven, signaling a recalibration rather than a collapse.

About 17% of logistics professionals reported freight volumes in October and November that fell short of historical peak-season expectations, according to a late-2025 Tech.co survey. The experience prompted companies to reassess cost structures, labor models, and capacity planning assumptions heading into 2026.

The slowdown dovetailed with other external cost pressures—including rising diesel prices—squeezing margins and exacerbating financial strain across logistics operations. Rather than leaning on previous cost-relief measures such as financing or debt restructuring, many firms instead embraced workforce reductions as a more immediate means of adjusting to the shifting market, the survey shows.

Here is how this challenge is playing out:

Pressure on priorities: The percentage of logistics professionals prioritizing financial pressure management increased, reflecting broader economic stress within the sector.

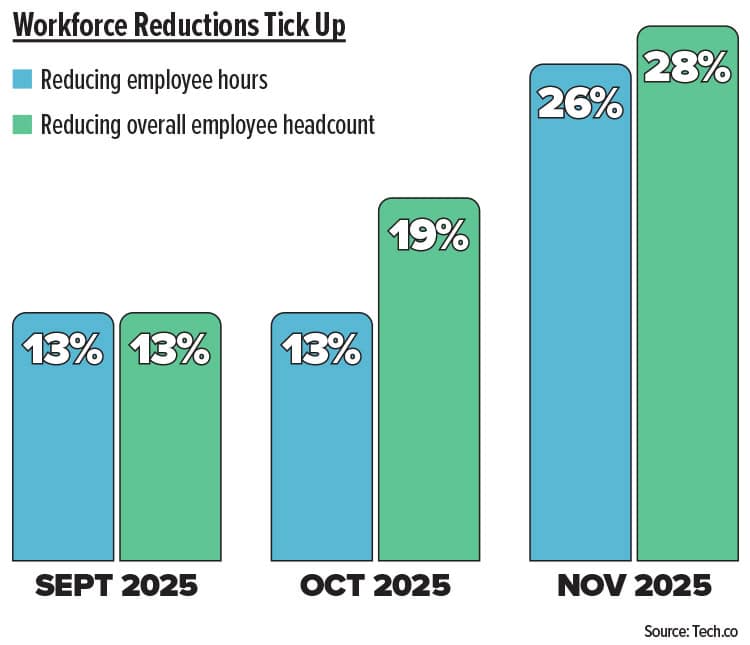

Cost-cutting via staffing: Since September 2025, the share of companies reducing employee headcount rose by roughly 15%, while those cutting employee hours increased about 13%.

Shift in strategy: Workforce reductions are replacing previously more common responses like financing and debt restructuring, which have declined as cost-management tactics.

The logistics sector has spent much of the past several years adapting to volatility and chronic labor shortages, so a downturn in freight demand signals a turning point. Companies that can recalibrate quickly—balancing capacity, cost, and workforce flexibility—may be better positioned to weather what some analysts have called a prolonged freight market softening, according to the Tech.co research.

Sector Spotlight: Retail

Retail supply chains are navigating one of the strongest strategic inflection points in years as tariffs, technology gaps, and nearshoring reshape how goods are sourced, moved, and delivered. Retail Supply Chain Moves That Will Define 2026, a new survey of 250 retail supply chain leaders commissioned by WSI | Kase and conducted by TrendCandy, finds that organizations are increasingly prioritizing resilience and agility over traditional speed‑oriented models in preparation for 2026.

The rapid pace of change reflects broader geopolitical and economic pressures that have forced retail executives to rethink long‑held assumptions about global sourcing and network design.

In the face of sustained tariff turbulence and volatile trade costs, many retailers are accelerating nearshoring and regionalization efforts to reduce exposure and improve control over their networks, the report shows. At the same time, internal challenges such as technology misalignment and infrastructure limitations are emerging as critical vulnerabilities that could slow transformation.

These top trends highlight the key factors set to impact the retail sector in 2026:

Tariff pressure is transforming strategy: About three‑quarters of retail supply chain leaders say tariff volatility is redefining their plans for 2026, driving a shift toward regionalization and diversified sourcing to reduce risk.

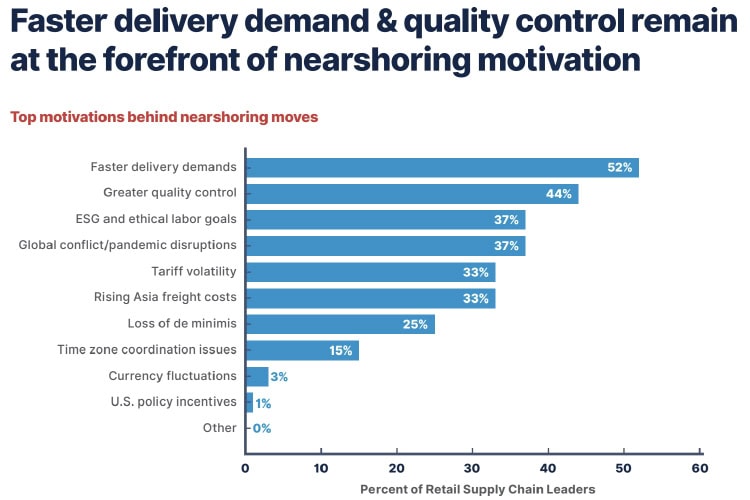

Nearshoring gains momentum, readiness lags: While 87% of respondents plan nearshoring pilots in Mexico or Central America over the next two years, most say their networks are not yet fully prepared for truly regional fulfillment. (See chart below to see what factors motivate retailers toward nearshoring.)

Tech gaps hinder execution: A majority of leaders (84%) report difficulties aligning IT systems—including order management, warehouse, and transportation platforms—for real‑time, multi‑node fulfillment, underscoring a need for better integration.

Visibility is now essential: Nearly nine in 10 leaders say transparency into supply chain changes is key to maintaining customer trust and loyalty, highlighting the expanding role of data and real‑time insight.

3PL partnerships under review: More than 80% of respondents expect to rethink 3PL relationships in 2026, seeking partners with regional reach and technology compatibility to support new strategies.

WOW Warehouses

2025 proved to be a banner year for launching massive distribution and fulfillment centers. Driven by strong ecommerce growth, automation efficiencies, and a focus on key regional U.S. markets, retailers and other companies went big on supply chain expansion.

Here’s a roundup of some of the largest facilities that were announced or opened in 2025:

TRADER JOE’S (ISLANDIA, NY): A nearly 1-million-square-foot complex with warehouse, cold storage, and freezer space to support Long Island stores and expansion.

GRAINGER (GRESHAM, OR): A 1.5-million-square-foot bulk warehouse, set to be the company’s largest in the Pacific Northwest, boosting next-day delivery capabilities.

LEGO (NEAR RICHMOND, VA): A massive $366-million investment in a 2-million-square-foot facility to meet high demand for Lego products.

WALMART (GASTON COUNTY, NC): A new fulfillment center for large items, enhancing next-day delivery for Walmart’s growing ecommerce business.

GREENBOX SYSTEMS (JACKSON, GA): An automated, AI-driven warehouse targeting efficient service for Atlanta and the Port of Savannah.

Amazon opened several key sites, including:

VIRGINIA BEACH, VA: A new robotics fulfillment center and delivery station expected to add more than 1,000 jobs.

ELKHART, IN: An 800,000-square-foot robotics hub with five floors.

TALLAHASSEE, FL: A robotics fulfillment center and five delivery stations bringing more than 2,000 jobs.

BATON ROUGE, LA: Amazon’s first robotics fulfillment center in Louisiana, boosting regional capacity.

Automation’s Next Leap

Business automation continues to accelerate, and supply chain organizations are seeing real returns. Nearly all companies (95%) surveyed in Camunda’s 2026 State of Agentic Orchestration and Automation report business growth from process automation in the past year, as automation expands into high-impact areas such as onboarding, claims, order fulfillment, and fraud detection.

The next major boost is expected to come from agentic AI. However, many organizations are not yet ready to scale this shift, according to Camunda’s research. While 71% of respondents already use AI agents, only 11% of agentic use cases have reached production, and 73% report a gap between their vision for agentic AI and current reality. The study also details the importance of AI orchestration for maximum benefit.

AI in the Future

- 90% > of respondents say AI needs to be orchestrated like any other endpoint within automated business processes to ensure compliance with regulations

- 88% > say AI needs to be orchestrated across business processes if they are to get maximum benefit from their investments

- 73% > are looking to use AI to better analyze and improve processes

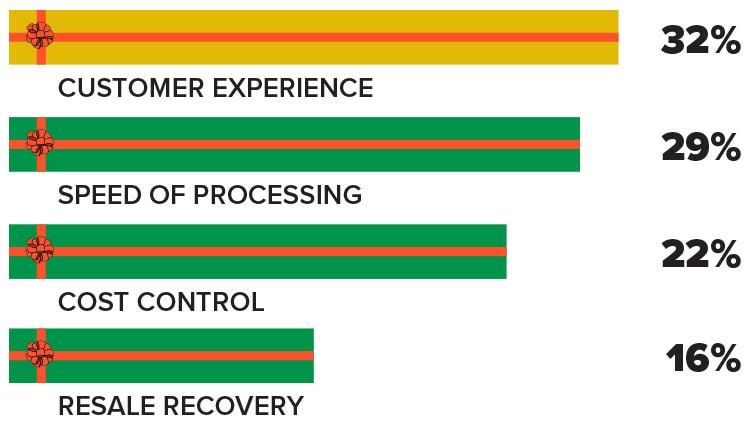

Customer Focus Tops Returns Priorities

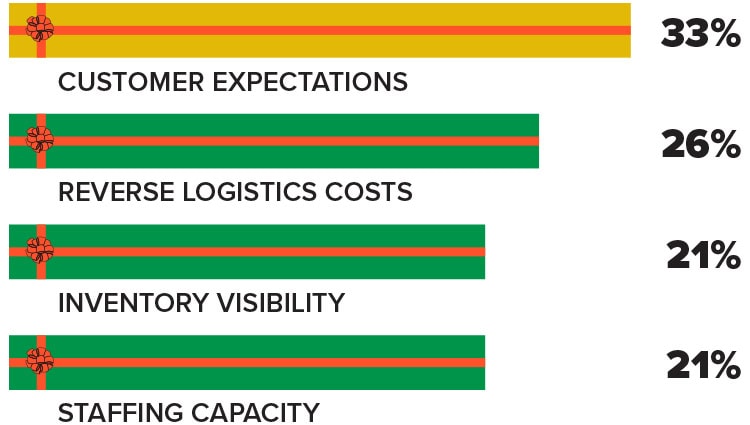

Once the seasonal shopping rush subsides, attention shifts to the post-holiday returns season. We asked the Inbound Logistics LinkedIn audience about their top priorities and greatest challenges as they work through the onslaught of both in-store and online returns—and a clear winner emerged. Turns out, if customers ain’t happy, ain’t nobody happy.

What’s your biggest challenge during the post-holiday returns surge?

What’s your top priority when returns volumes surge?

Source: Inbound Logistics LinkedIn poll